Practical Differences between Ind AS vs AS

The main objective of Accounting Standards is to remove variations in the treatment of several accounting aspects and to bring about standardization in presentation. They intend to harmonize the diverse accounting policies followed in the preparation and presentation of financial statements by different reporting enterprises so as to facilitate comparison among themselves. India has two sets of Accounting Standards. Ind AS vs AS :

- AS or Indian GAAP under Companies (Accounting Standard) Rules, 2021

- Ind AS under Companies (Indian Accounting Standards) Rules, 2015

‘AS’ are traditional Accounting standards followed in India for decades. They have been amended from time to time and serve the purpose of reporting for small and medium entities. For large enterprises, there is a need to follow a global reporting standard because their reports are used globally. Indian Accounting Standards (Ind AS) are a set of accounting standards converged with International Financial Reporting Standards (IFRS). The ‘Ind AS’ are named and numbered in the same way as the corresponding IFRS.

Both AS and Ind AS are formulated by the Accounting Standards Board of the Institute of Chartered Accountants of India. National Financial Reporting Authority (NFRA) recommends these standards to the Ministry of Corporate Affairs. The Ministry of Corporate Affairs notifies these accounting standards.

Applicability on Companies (Ind AS vs AS)

| Criteria | Ind AS | AS |

|---|---|---|

| Listed Company or in process of Listing | Applicable from 1 April 2017 or 1 April 2016 | Not Applicable |

| Unlisted Company (Networth 250 Crores or more) | Applicable from 1 April 2017 | Not Applicable |

| Unlisted Company (Networth less than 250 Crores) | Not Applicable (Can apply voluntarily) | Applicable |

| Holding, Subsidiary, Joint venture or Associate companies of companies covered under Ind AS | Applicable | Not Applicable |

| Banks, NBFCs, and Insurance companies (Networth 250 Crores or more) | Applicable from 1 April 2019 or 1 April 2018 | Not Applicable |

| Banks, NBFCs, and Insurance companies (Networth less than 250 Crores) | Not Applicable | Applicable |

Differences in Valuation and Recognition (Ind AS vs AS)

| Criteria | Ind AS | AS |

|---|---|---|

| Valuation | The majority of valuations are at Fair Value. | Most valuations are at Historical Cost. |

| Property Plant & Equipment Valuation | Option to value PPE at Fair value or at cost. | Valuation of PPE at Historical cost only. |

| Leases | Ind AS 116 eliminates the requirement of classification of leases into operating or finance leases. Lessee will recognize Right of Use asset, depreciation expense, Lease liability, and interest expense for all leases with a term of more than 12 months unless the underlying asset is of low value. | AS 19 requires a lessee to classify leases as finance or operating leases. Under an operating lease, the asset is not recognised. Under a finance lease, PPE asset is recognised. |

| Investment Valuation | Investments are covered under Financial Instruments Ind AS 109. All Investments (whether Current or Non-Current) have to be valued as per Amortised cost, or FVTPL, or FVTOCI. | Investments are covered under AS 13. The use of Fair value is limited to Current Investments which are required to be recognised at the lower of cost and fair value. |

| Dividend on Redeemable Preference Share | Dividend on Redeemable Preference Share to be recognized as interest cost. | Treated as a dividend. |

Differences in Disclosures in Schedule III (Ind AS vs AS)

| Criteria | Ind AS (Division II) | AS (Division I) |

|---|---|---|

| Quantity of Disclosures | Enhanced Disclosures. | Moderate Disclosures. |

| Balance Sheet Format | Assets are disclosed before Equity and Liabilities | Assets are disclosed after Equity and Liabilities |

| Investment Property | Disclosure of Investment Property separately. There is a separate Ind AS on Investment Properties. | Disclosed under Non-Current Investments. No separate AS for Investment Property. |

| Goodwill | Disclosure of Goodwill separately from Other Intangibles. | Goodwill is shown under Intangible Assets. |

| Biological Assets | Disclosure of Biological Assets other than bearer plants separately. There is a separate Ind AS on Agriculture. | Biological Assets are shown along with other Property Plant and Equipment. No separate AS. |

| Right of Use Assets / Lease Liabilities | Separate disclosure of Right of Use (ROU) assets in PPE. Separate disclosure of Lease Liabilities under Current or Non-Current Financial Liabilities. | ROU asset is not recognised. Assets under finance lease are specified under each class of asset. Finance Lease obligations are shown under Long term borrowings / other current liabilities. |

| Financial Assets / Liabilities | Disclosure of separate heads of Financial Assets & Financial Liabilities. Ind AS 109 for Financial Instruments is mandatory and its disclosure requires Financial Assets & Liabilities to be shown separately. | Accounting Standards on Financial Instruments (AS 30, 31, 32) are withdrawn, so they are not disclosed in the Balance Sheet. |

| Investment classification | Apart from basic disclosures, additional disclosure is required for Investments at amortized cost, Investments at FVOCI, and Investments at FVTPL. | Basic disclosures like quoted/unquoted, subsidiary/associate/joint-venture, and type of instrument, is only required. |

| Name of the company in which investment is made | If invested in a subsidiary, joint venture or associate then only the name of the company has to be given otherwise no requirement to give the name of the company. | Details shall be given of the names of the company for all the investments. |

| Bank Deposits | Bank Deposits maturing after more than 12 months are shown under Other Financial Assets instead of Cash and Cash Equivalents as they are Non-Current Assets. | All Bank Deposits are shown under Cash and Cash Equivalents under Current Assets. |

| Loans and Advances | Loans are shown as financial assets as they are recoverable in cash. Only those Advances which are recoverable in cash are shown under financial assets. Advances recoverable in kind in the form of goods or services are shown as Other assets. | All Loans and advances whether recoverable in cash or kind are shown under the same head, Loans and advances. |

| Current Tax Assets / Liabilities | Disclosure of Current Tax Assets / Liabilities (Net) on the face of the Balance Sheet. | (Provision for Tax + Advance Tax + TDS) is a net liability, then shown under Provisions otherwise shown as Loans and advances. |

| MAT Credit | Grouped with Deferred Tax in P&L. Grouped with Deferred Tax Assets (net) in the Balance Sheet. A separate note is provided for the amount of MAT Credit at both places. | Presented as a separate line item by a reduction from the Current tax in P&L. Shown under Short-term / Long-term loans and advances in the Balance Sheet. |

| Share Capital | Share Capital is renamed to Equity Share capital. Share Capital in Ind AS comprises only Equity share capital. Redeemable Preference shares are disclosed as Financial Liability and Equity. | Share Capital can be Equity or Preference Shares both. |

| Reserves and Surplus | Reserves and Surplus are replaced with Other Equity under Equity and Liabilities. | Reserves and surplus are shown as separate head in Equity and Liabilities. |

| Share Application Pending Allotment | Share Application Pending Allotment clubbed with Other Equity. | Share Application Pending Allotment is shown as a separate head in Equity and Liabilities. |

| Statement of Changes in Equity | Requires the financial statements to include a Statement of Changes in Equity to be shown as a part of the balance sheet. | No such disclosure |

| A separate line item for Income & Expense | Separate disclosure of any item of income or expenditure which exceeds 1% of the revenue from operations or Rs.10,00,000, whichever is higher. | AS prescribes disclosure of expenditure on various line items but no percentage of revenue is defined. |

| Extraordinary Item | Prohibits presentation of any item as an Extraordinary Item in the statement of profit and loss or in the notes. | No such prohibition |

| Other Comprehensive Income (OCI) | Other comprehensive income (OCI) is disclosed separately. | No concept of OCI |

| EPS | Disclosure of EPS for continuing operation and discontinuing operation separately. | Combined EPS disclosure. |

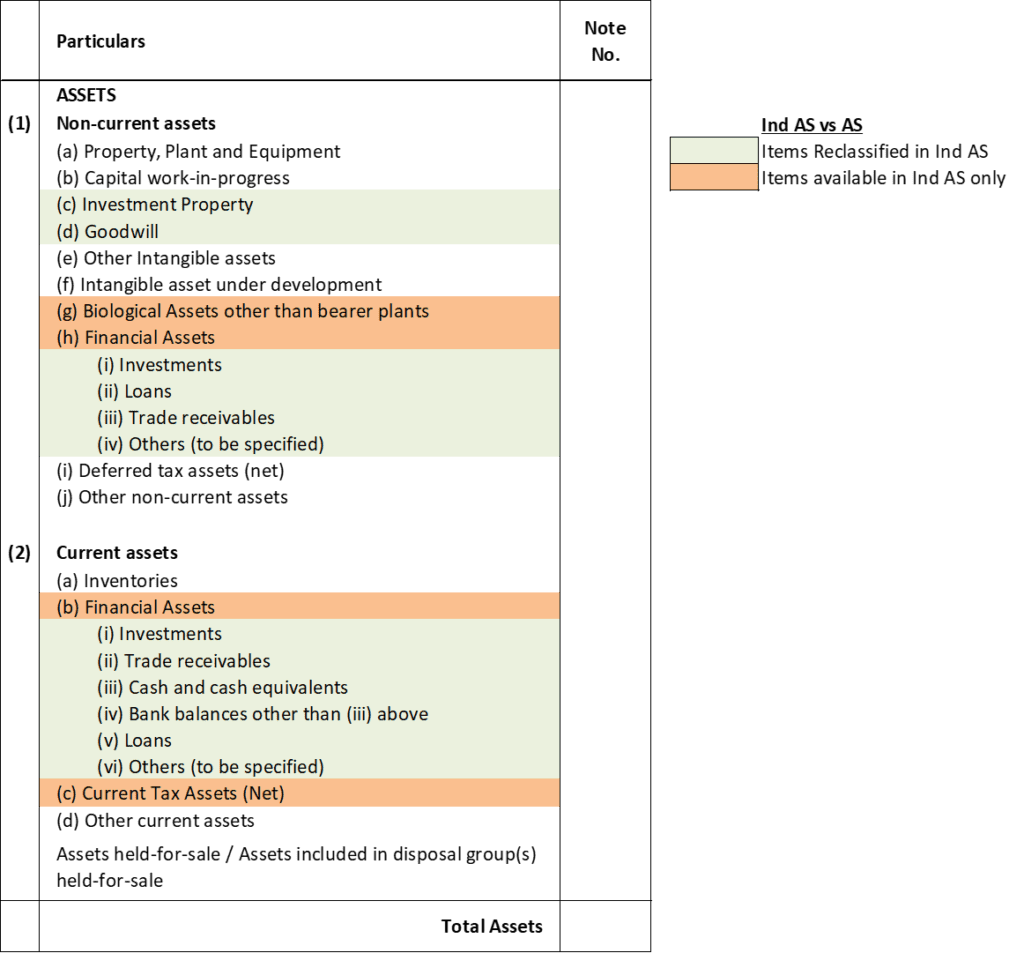

Presentation of Assets in Schedule III

Difference between Ind AS vs AS disclosures in Assets.

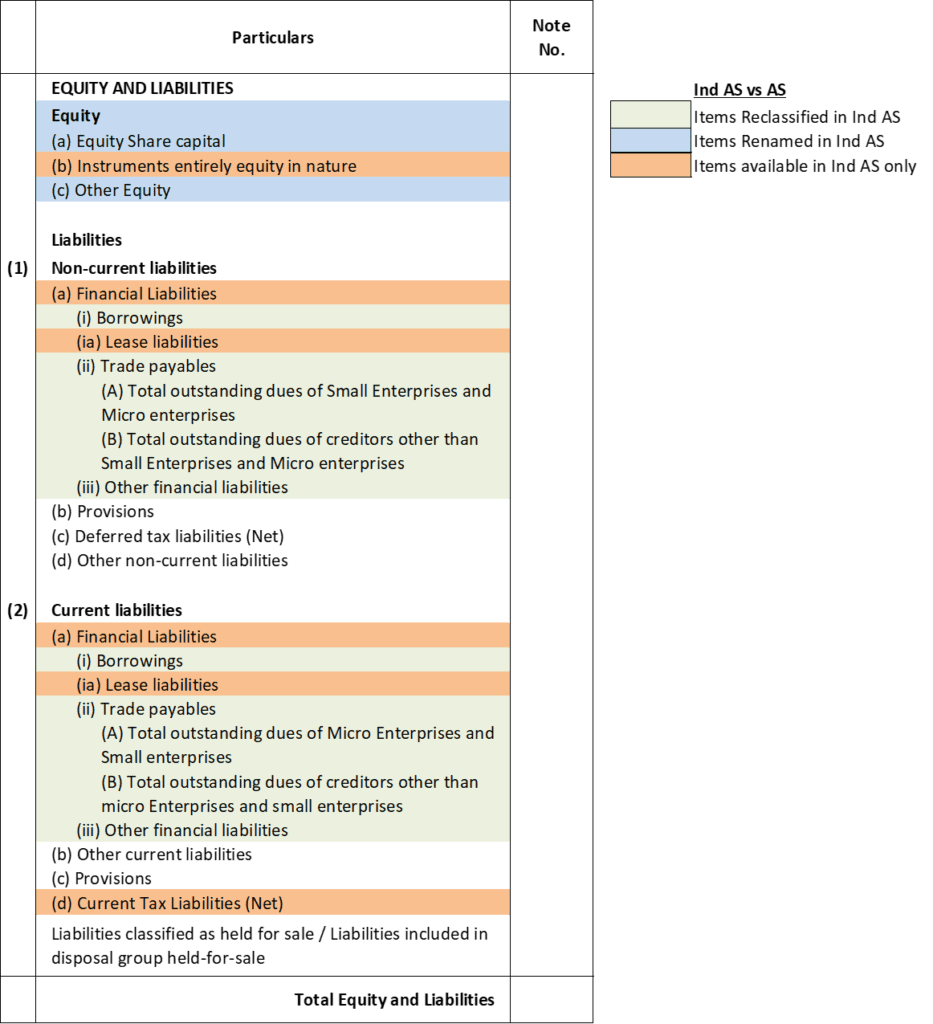

Presentation of Equity & Liabilities in Schedule III

Difference between Ind AS vs AS disclosures in Equity & Liabilities.

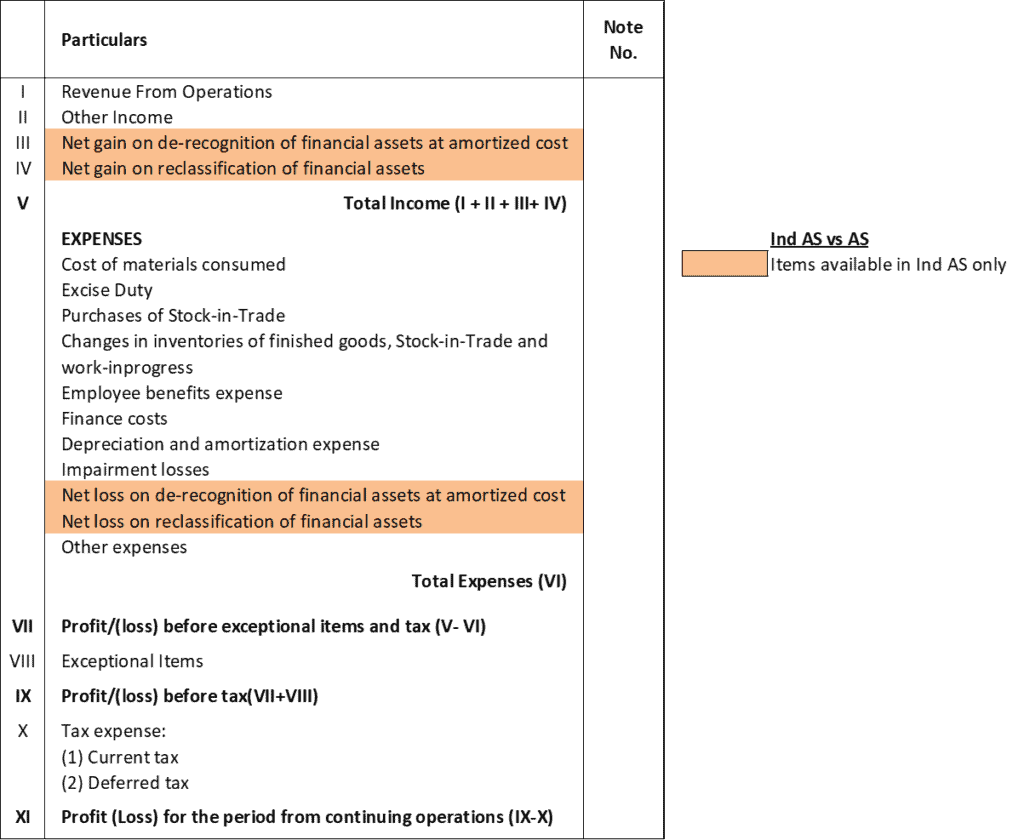

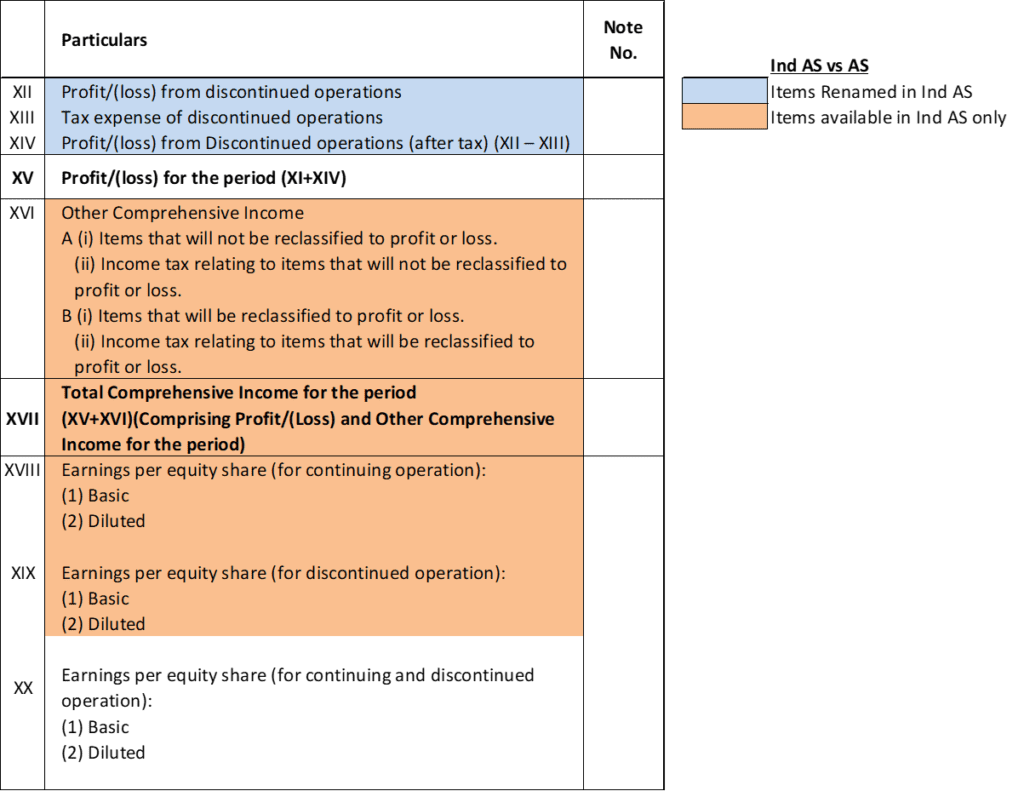

Presentation of Profit and Loss in Schedule III

Difference between Ind AS vs AS disclosures in Profit and Loss.