GST Input Credit Match

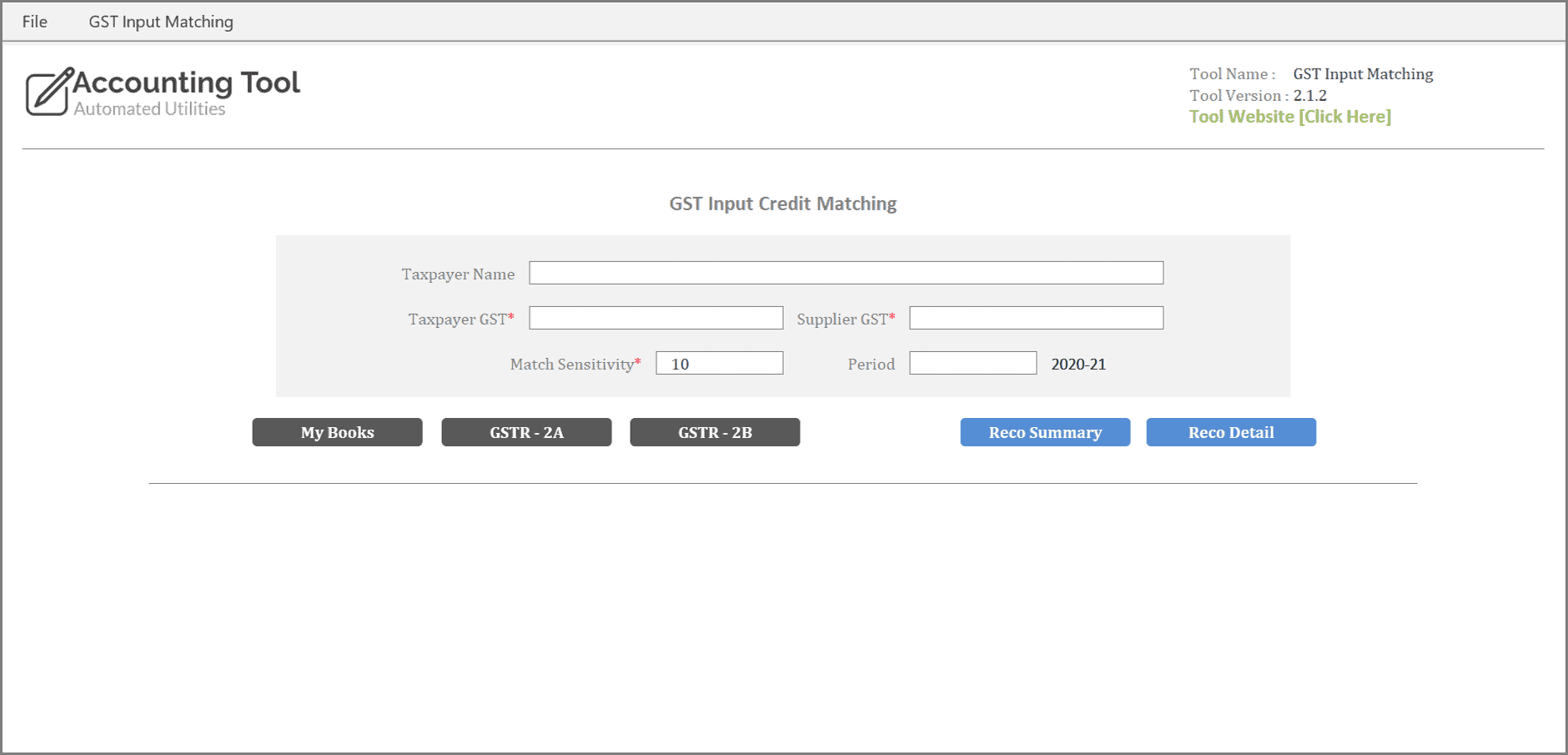

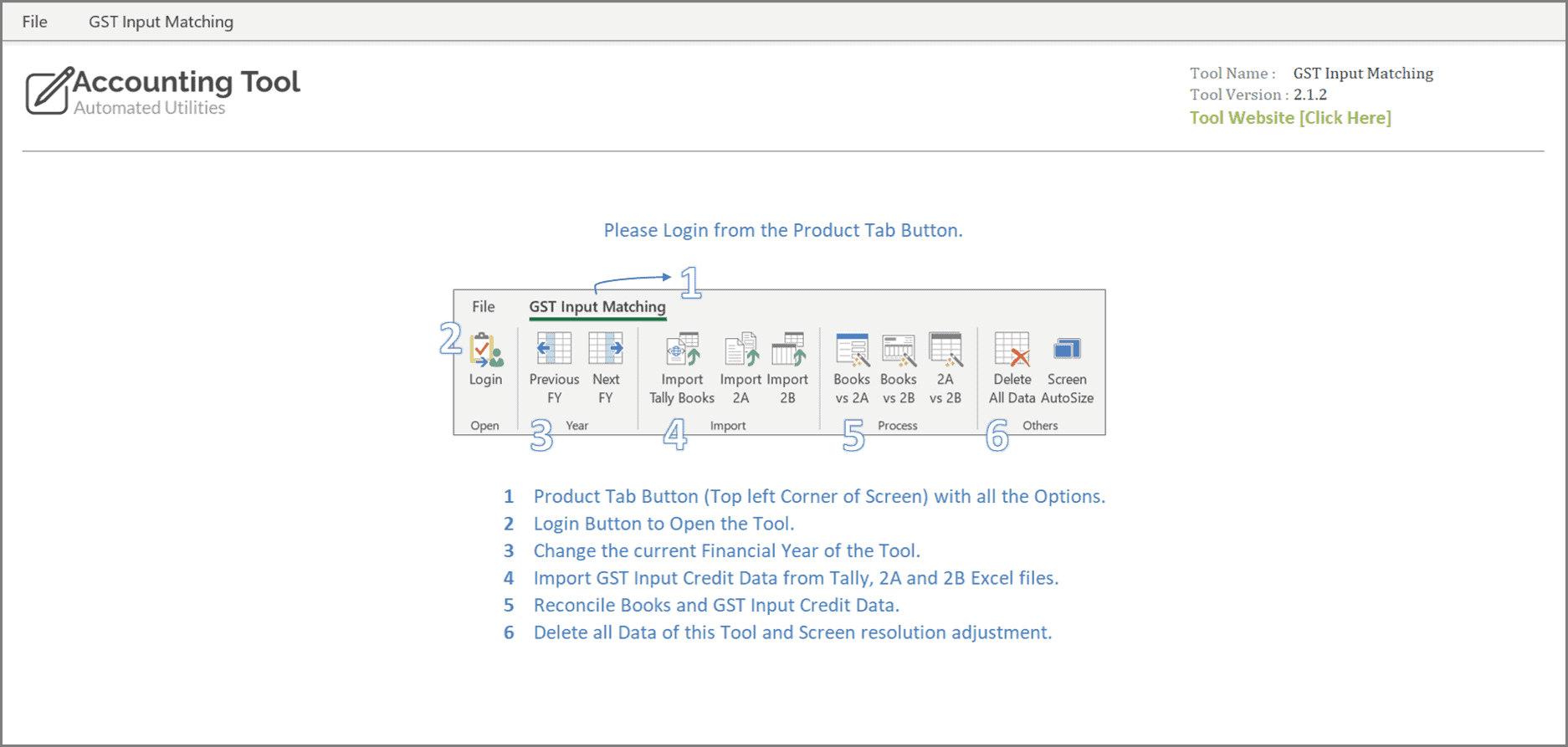

Purchase vs GSTR 2A vs GSTR 2B Reconciliation Software. Direct Import of Tally Data along with GSTR 2A, and GSTR 2B data from Portal.

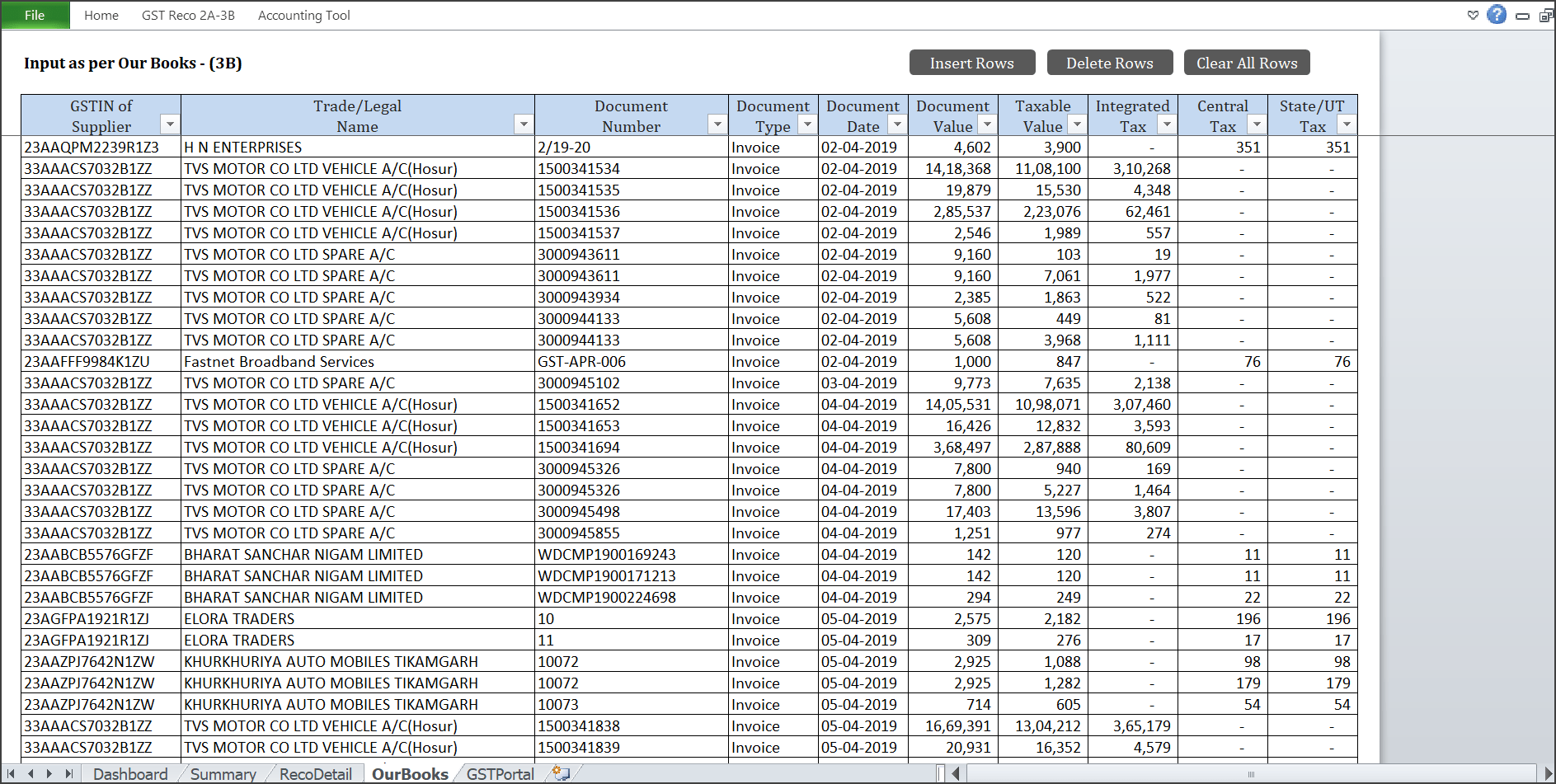

Tally Import

Direct Import of GST Input Data from Tally. Input Credit for Purchases, Fixed Assets, and Expenses gets imported automatically.

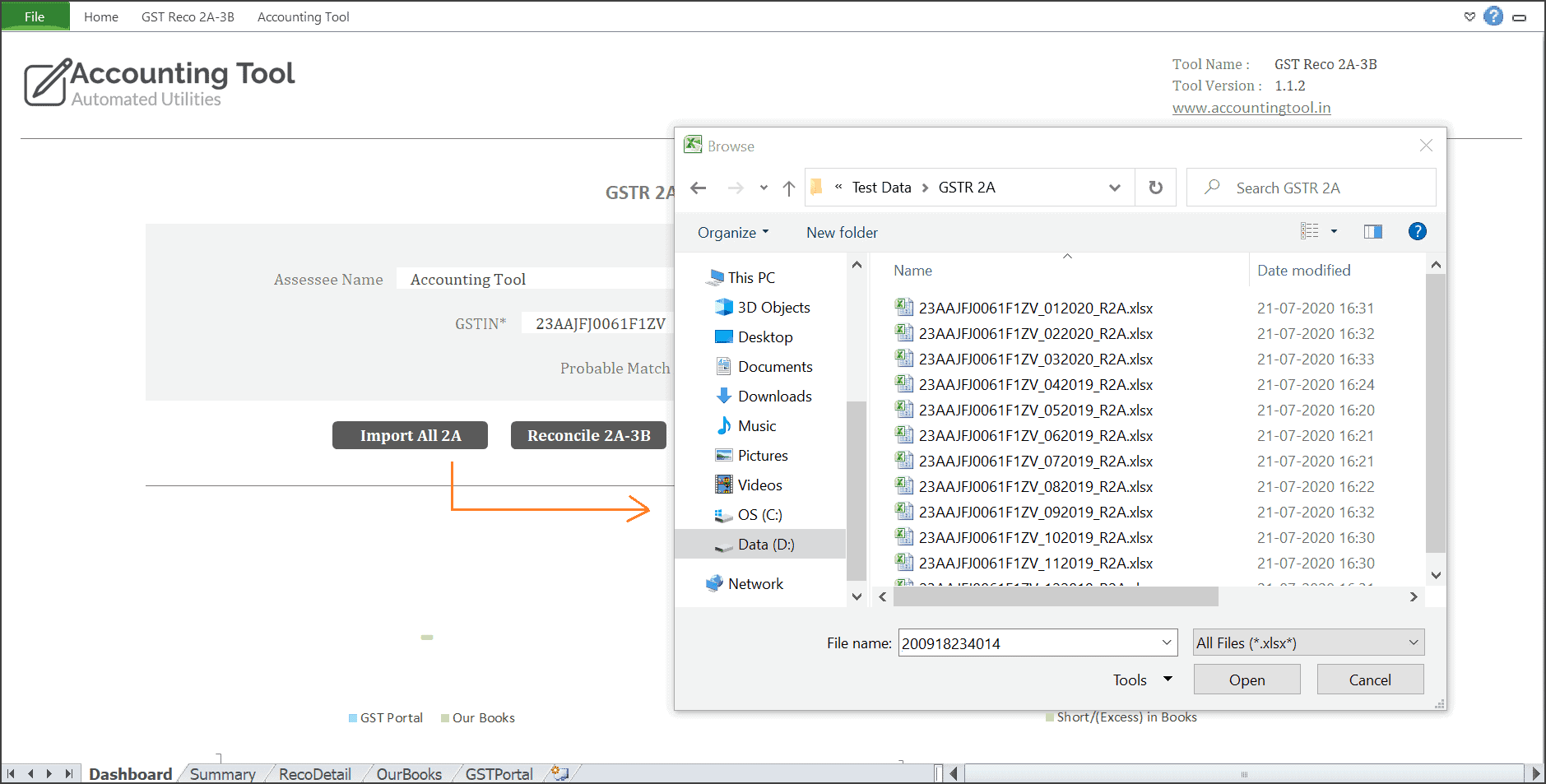

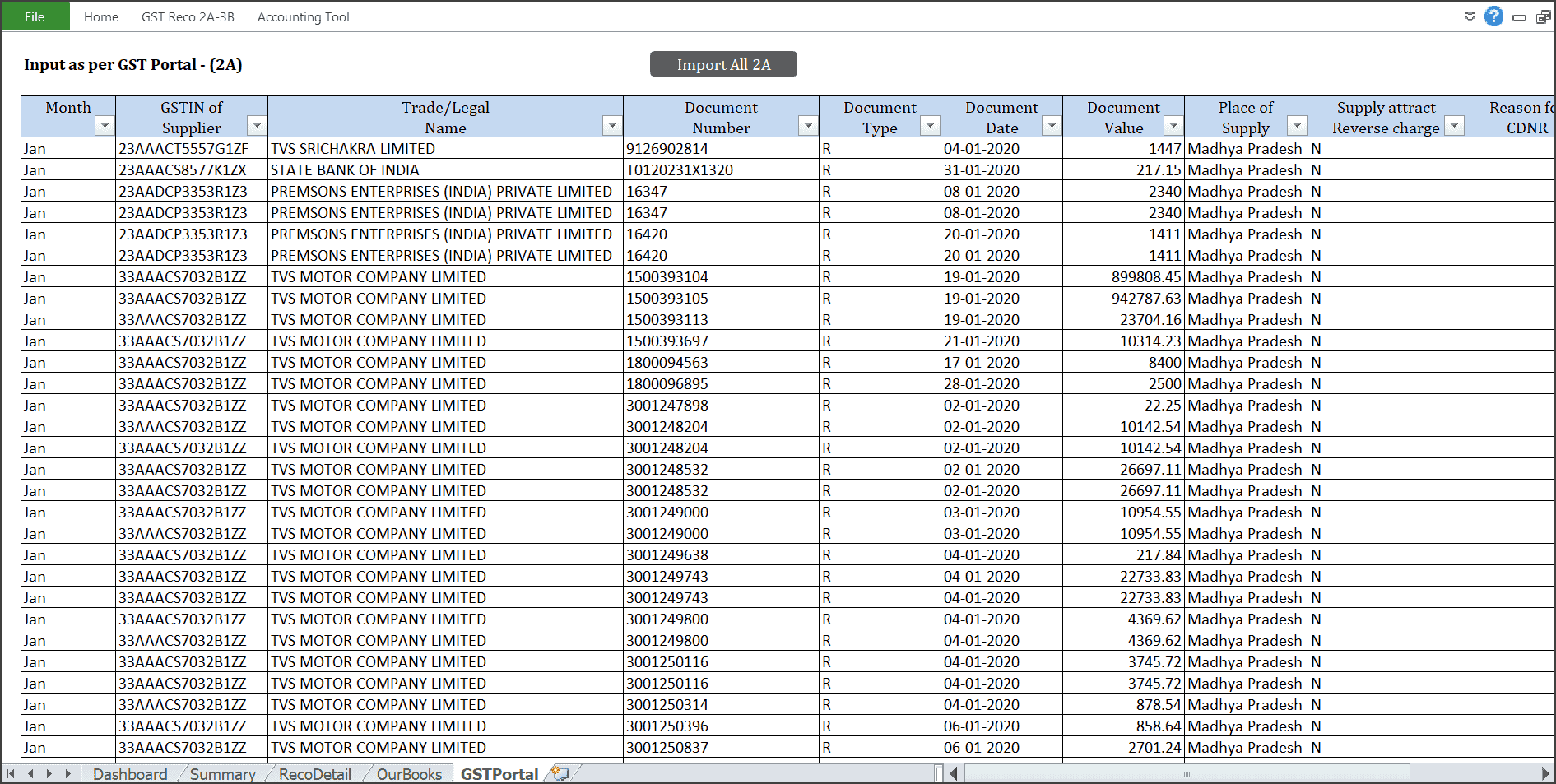

2A & 2B Import

Single Click Import of GSTR-2A and GSTR-2B data. Single month GSTR 2A/2B data, 12 months data or 19 months data can be imported at once.

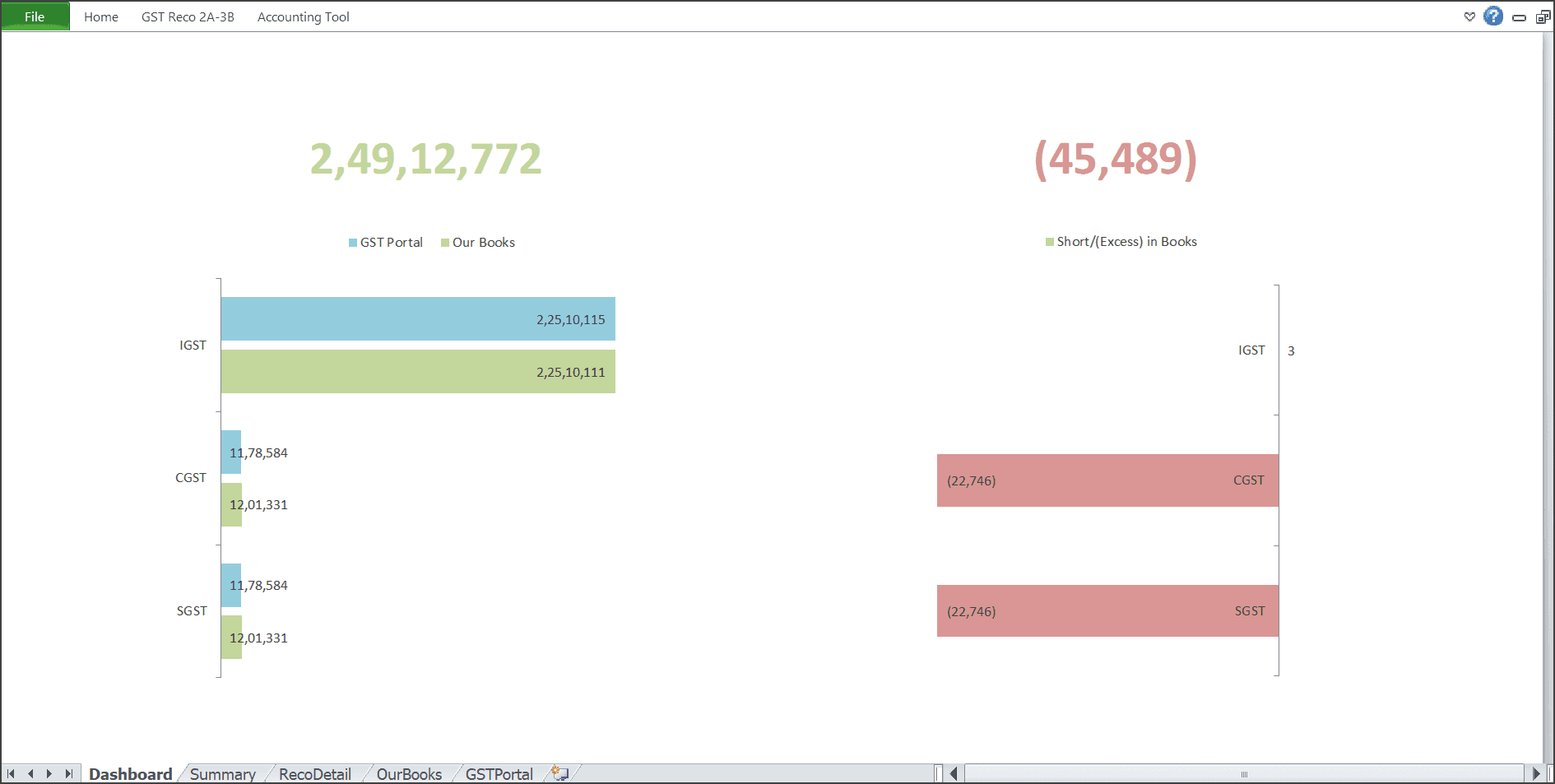

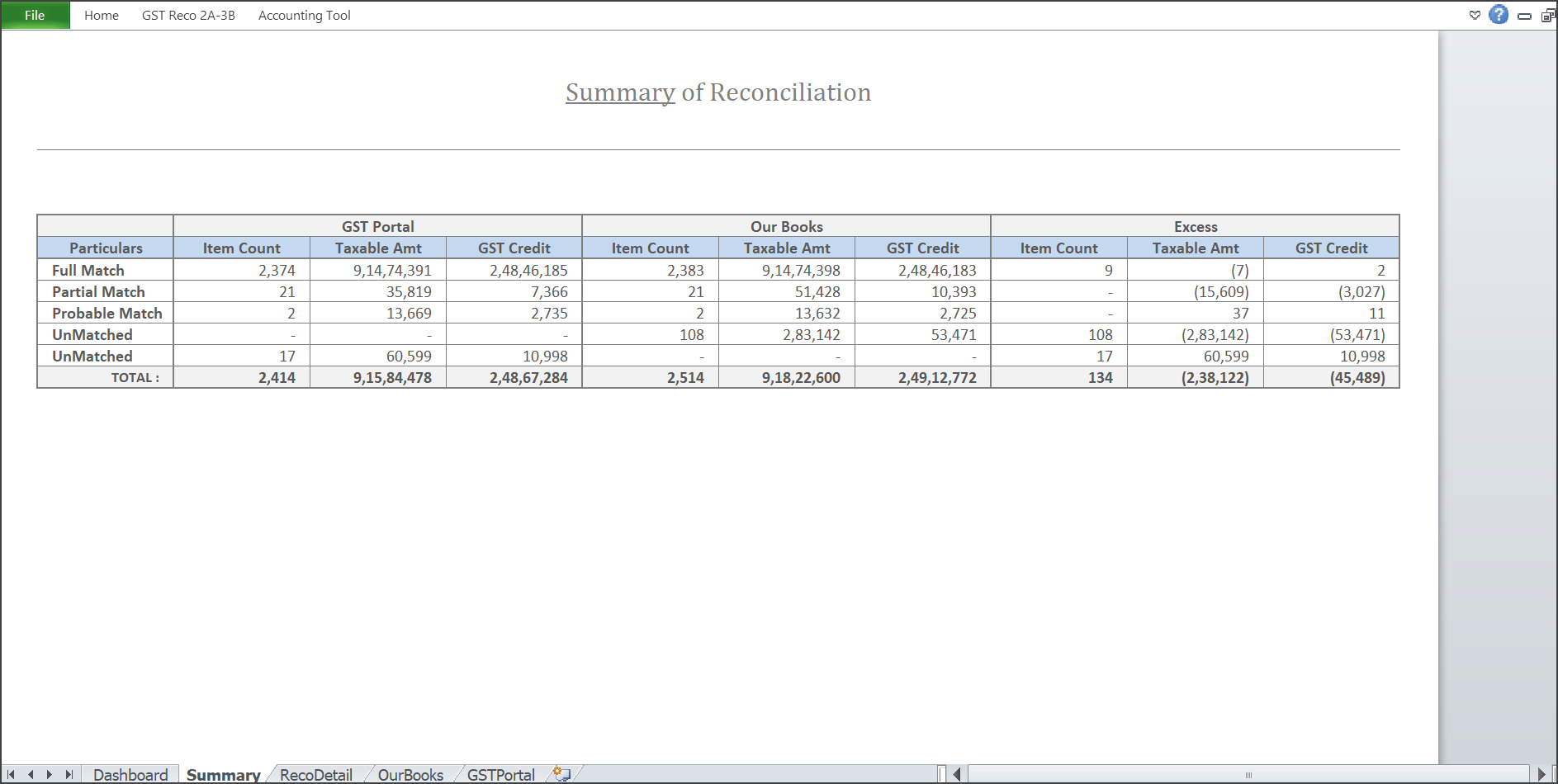

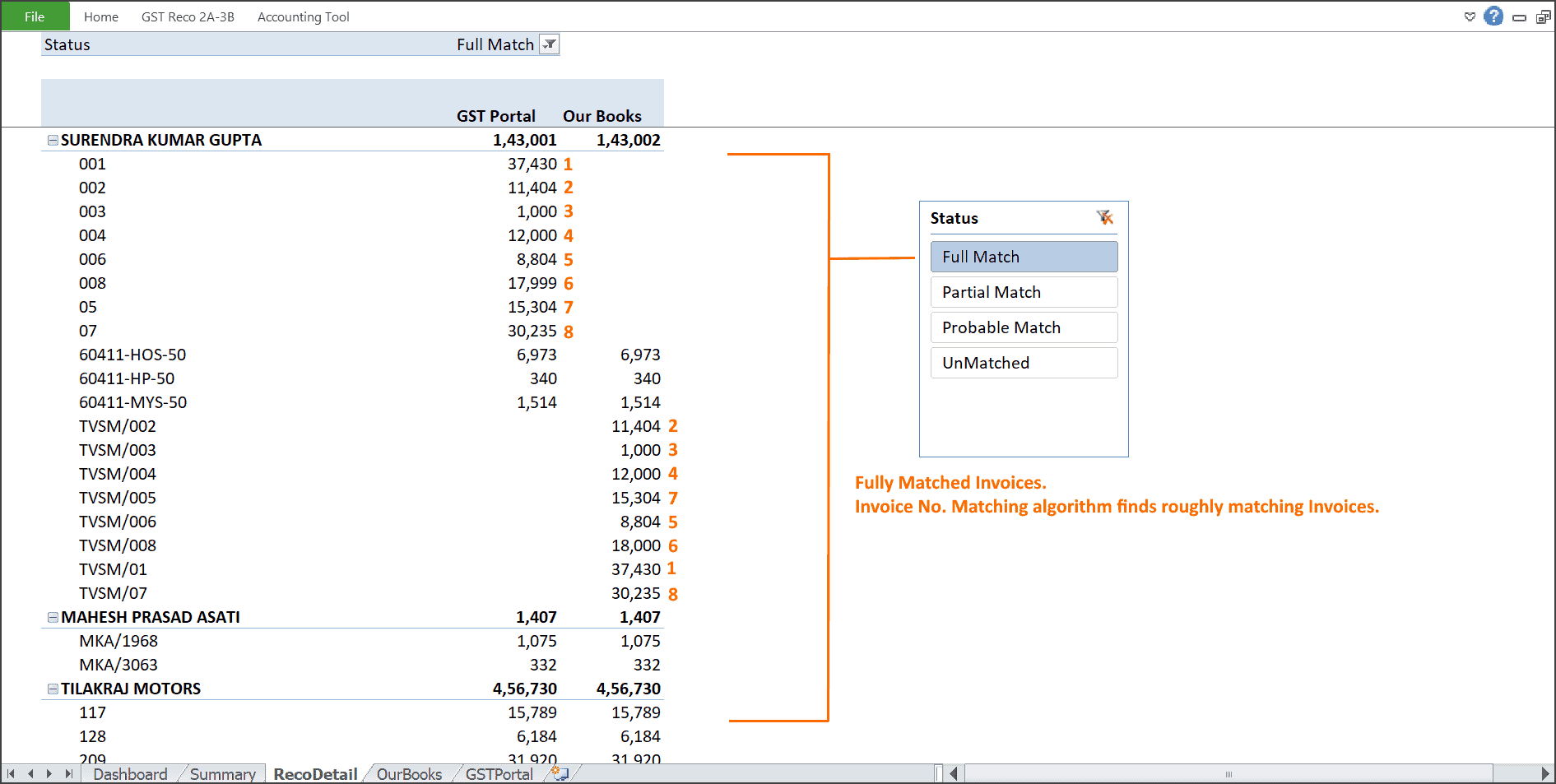

Books vs 2A vs 2B

GSTR-2A and GSTR-2B Reconciliation with Purchase Register. Smart Algorithm finds Partial and Probably Matching Invoices.

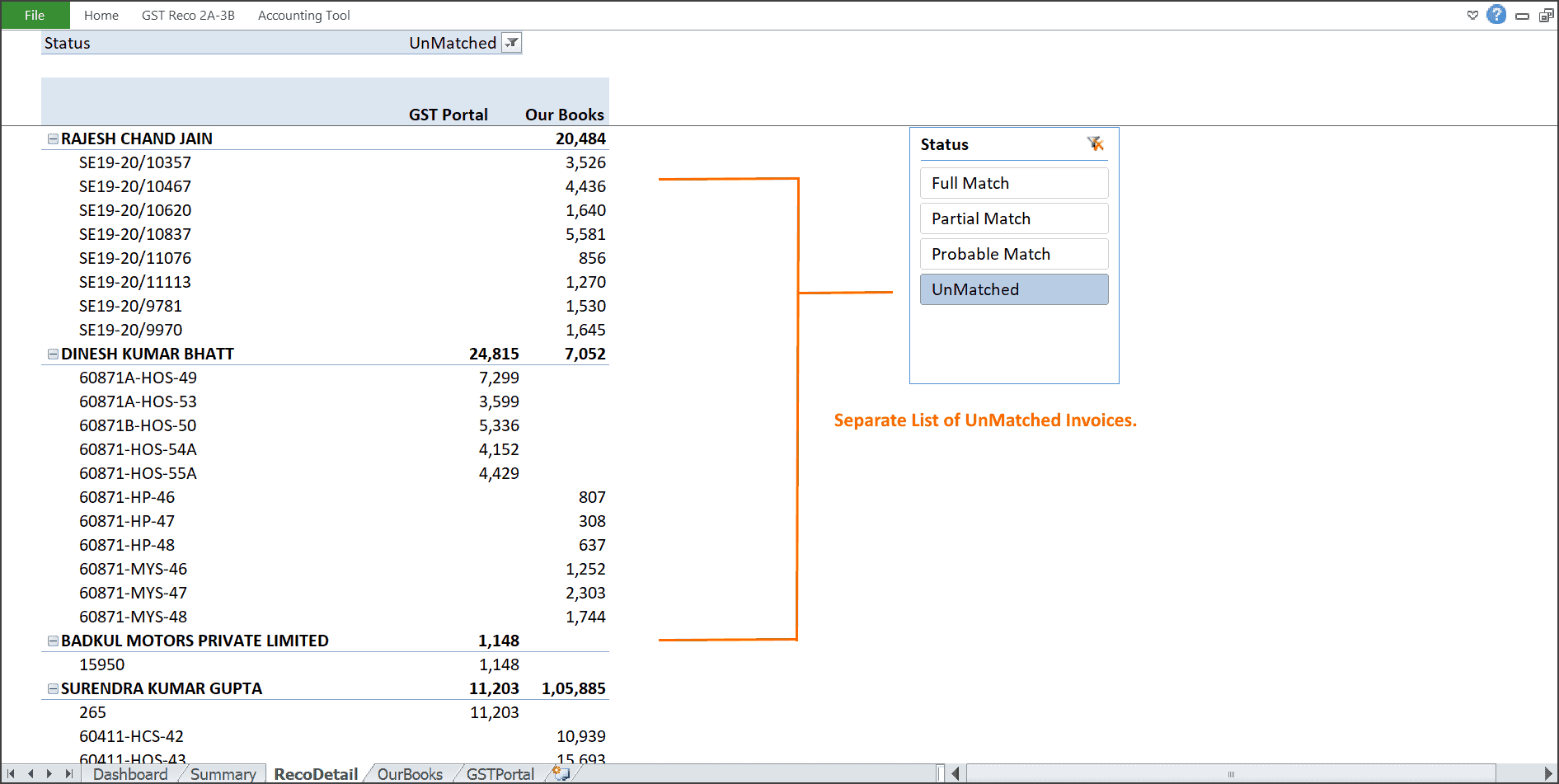

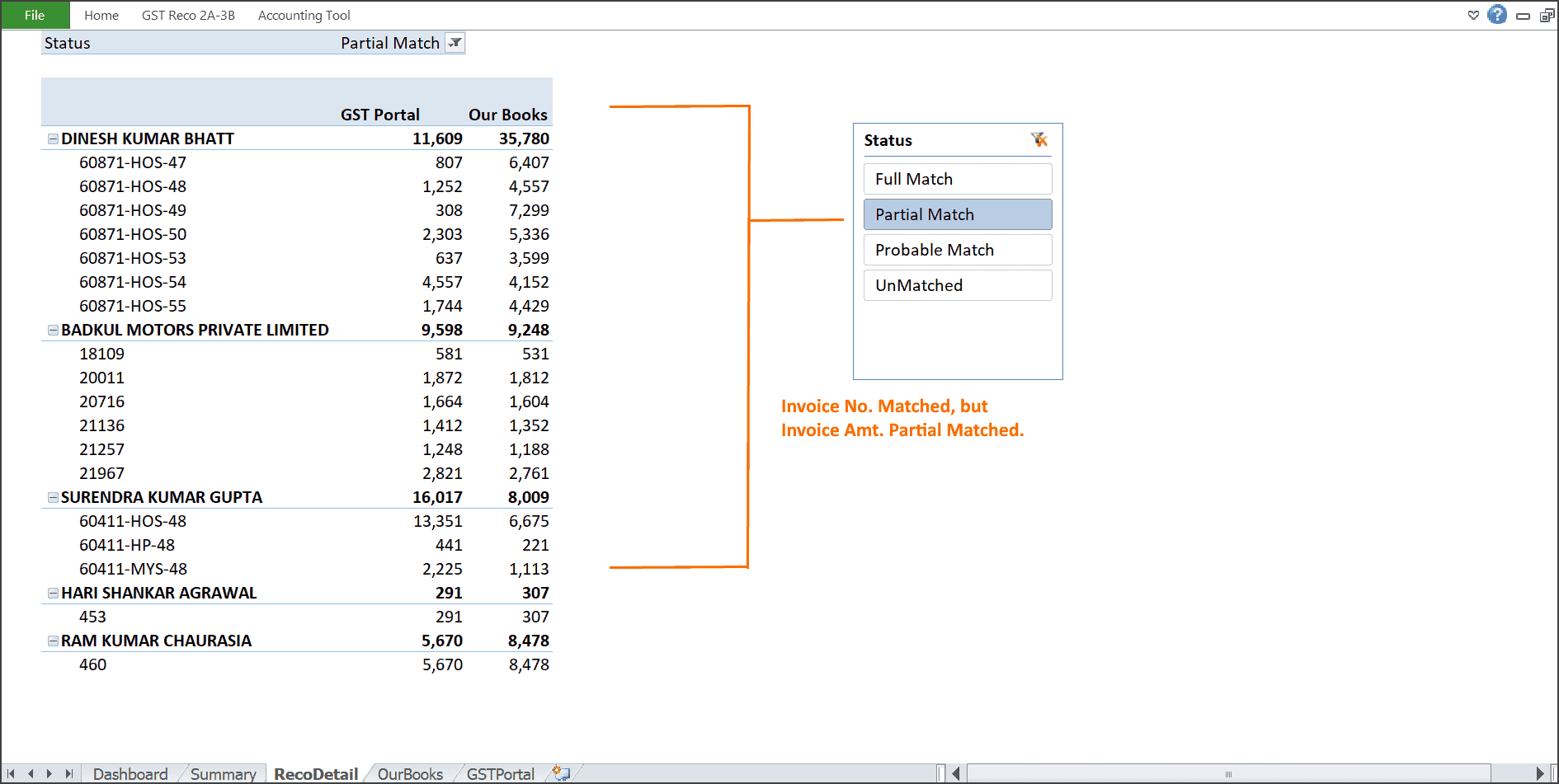

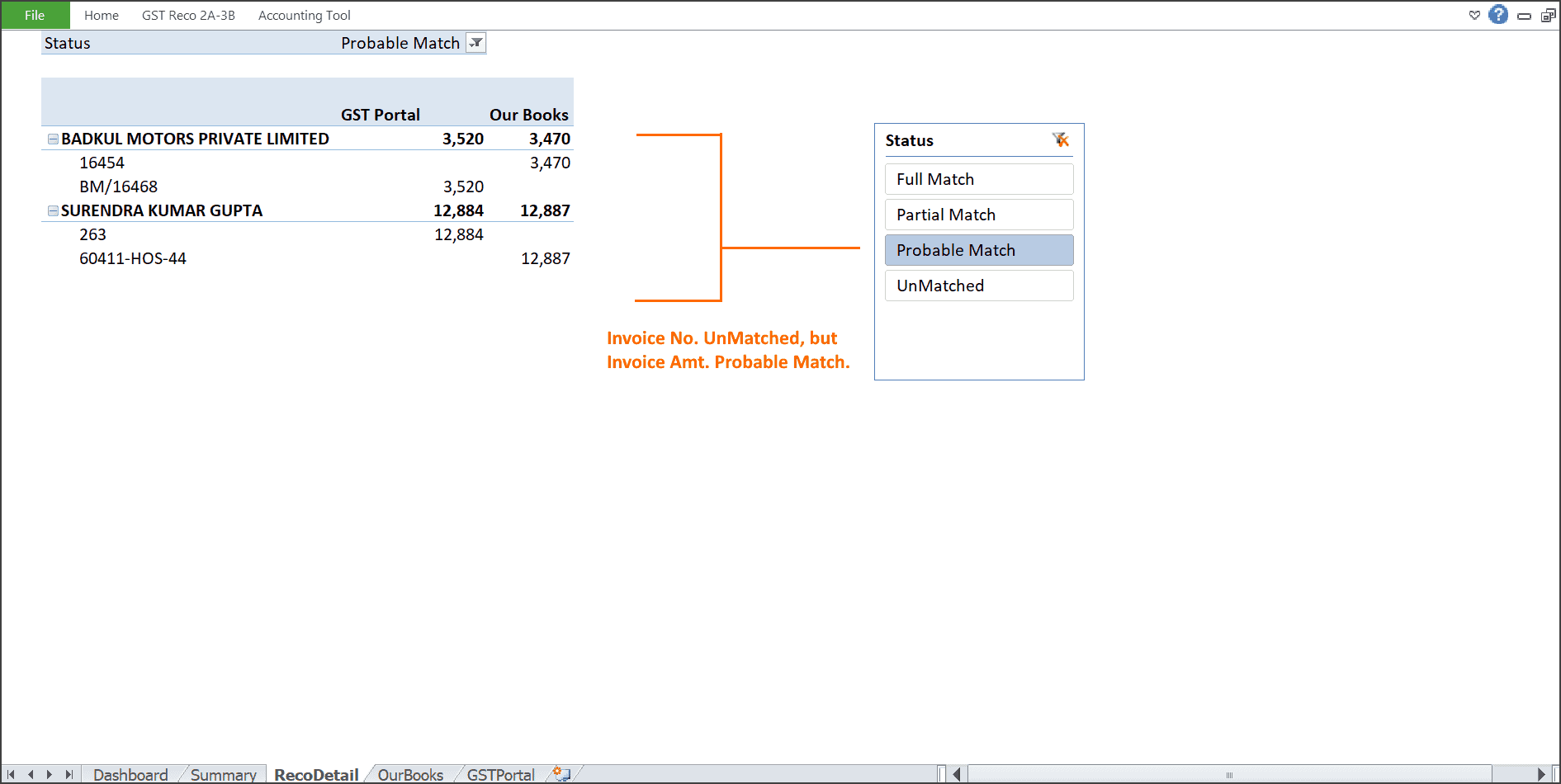

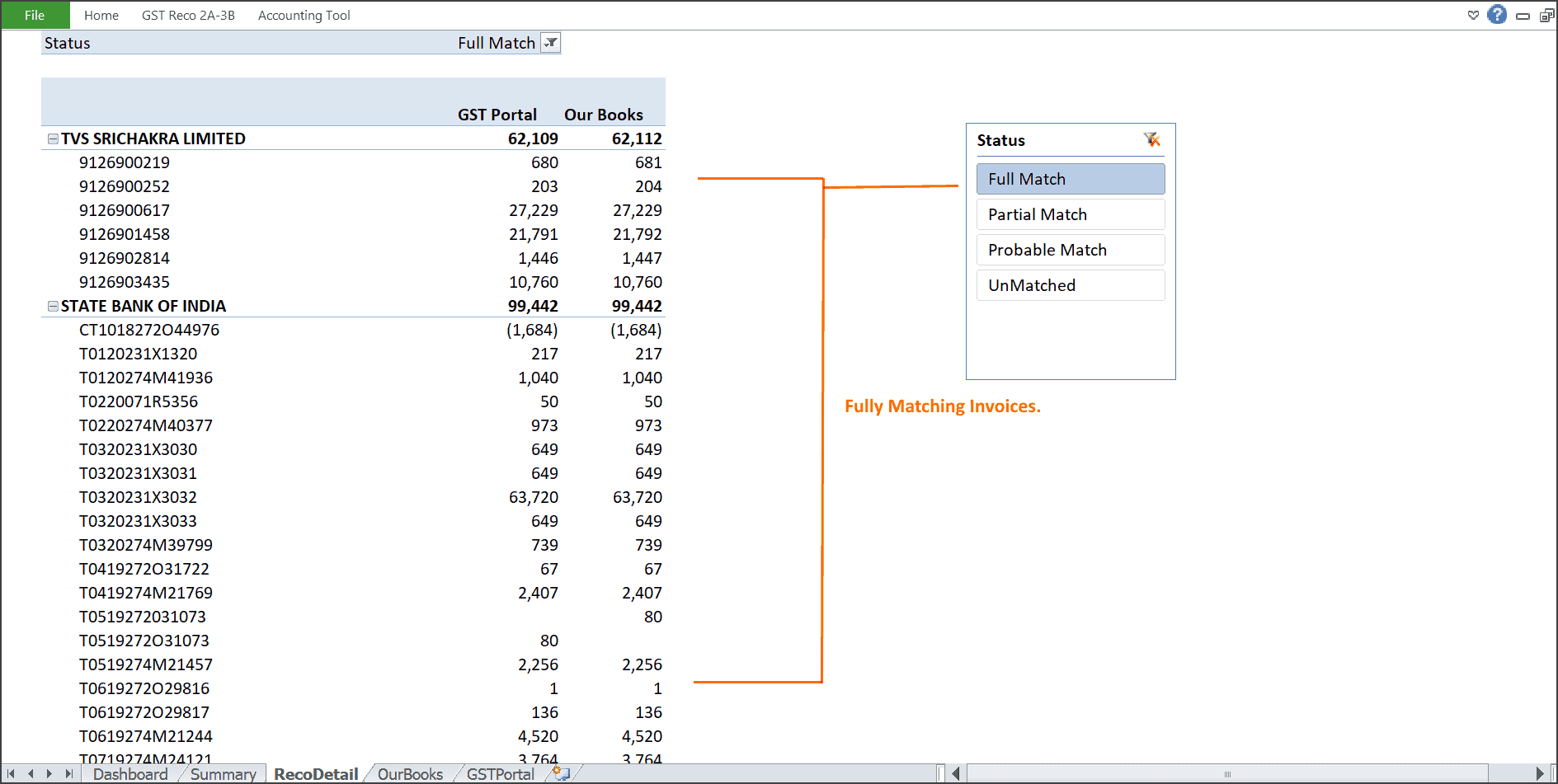

Match types and the required User Action

| Match Type | Meaning | User Action |

|---|---|---|

| Full Match | These documents are present at both places with the same amount. | No action is required for these transactions. |

| Probable Match | Document numbers for these transactions could not be matched but they may be a probable match based on amounts and the document dates. | The user needs to confirm whether probably matched documents are actually matching. |

| Partial MisMatch | Document numbers for these transactions were matched but the document amounts could not be matched. | The user needs to verify all the amounts in these documents. |

| Missing in Books | These documents were not found in the input credit records of the user but are present in the GST Portal. | Eligible credit – If the input credit was not recorded in books in the prior months or previous financial year then the user needs to make entries for these documents in his Books. Ineligible credit – No action is required for these transactions. |

| Missing in GSTR 2A/2B | These documents are present in the input credit records of the user but not in the GST portal. | The user needs to contact the suppliers and confirm whether they have missed the documents in their GSTR-1 returns. The user can take GST credit in the month when the supplier includes the documents in his GSTR-1. |

What is GSTR 2A

GSTR 2A is an auto-generated statement available on the GST Portal. It shows the purchases made from various suppliers and the amount of input tax credit available on those purchases for a particular month. It is a dynamic statement that gets updated as and when the suppliers file their GSTR-1 return. If the supplier delays filing GSTR-1 for a particular month, the purchaser has to go back and check the GSTR-2A records for that month to find the updated data and take credit in the subsequent months.

What is GSTR 2B

GSTR 2B is also an auto-generated statement available on the GST Portal. It also shows the purchases and input tax credit available on purchases but it is static in nature. This statement gets generated on the 14th of the next month and does not get updated afterward. If the supplier delays filing GSTR-1 for a particular month, the transaction is reflected in GSTR-2B in the subsequent month in which the supplier files his GSTR-1 and the purchaser can easily utilize the input tax credit in that month.

Importance of GST Input Credit Reconciliation

The following factors make it really important to reconcile the data as per books and GST Portal:

- To check whether any Invoice is not Missed or Recorded more than once,

- Reconciliation ensures that credit is being claimed for the tax which has been actually paid to the supplier.

- Tax evaders claiming ITC on the basis of fake invoices may be Penalized.

- In case the supplier has not recorded the outward supplies in GSTR-1, communication can be sent to the supplier to ensure that the discrepancies are corrected.

- Errors committed in GSTR-1 by Suppliers or GSTR-3B by Recipients can be rectified.

Reasons for the mismatch of GST Portal and Books

Following are the reasons for the differences between Books and GST Portal :

- The supplier did not file his GSTR-1 return for that month,

- The supplier filed the return for that month but missed the invoice,

- The supplier provided the wrong GST number of the purchaser in his return,

- Double booking of an invoice by the purchaser in his books,

- The supplier and purchaser booked the invoice in two different months and there is a timing difference.

Download GSTR 2A & GSTR 2B for a year

GST Input Credit Reports are available in Excel format on the GST Portal. Data on the portal is available on a monthly basis only, although yearly data can be downloaded from third-party applications.

Get It Now

Choose the most appropriate plan that meets your requirements.

Pro

₹3,499

1 Year, 1 PC

Plus

₹4,999

1 Year, 5 PC

Plus

₹7,499

1 Year, 10 PC

Reviews

There are no reviews yet.