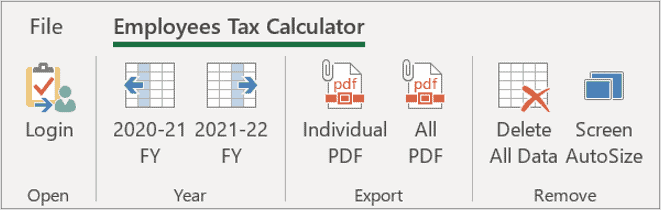

Employees Tax Calculator

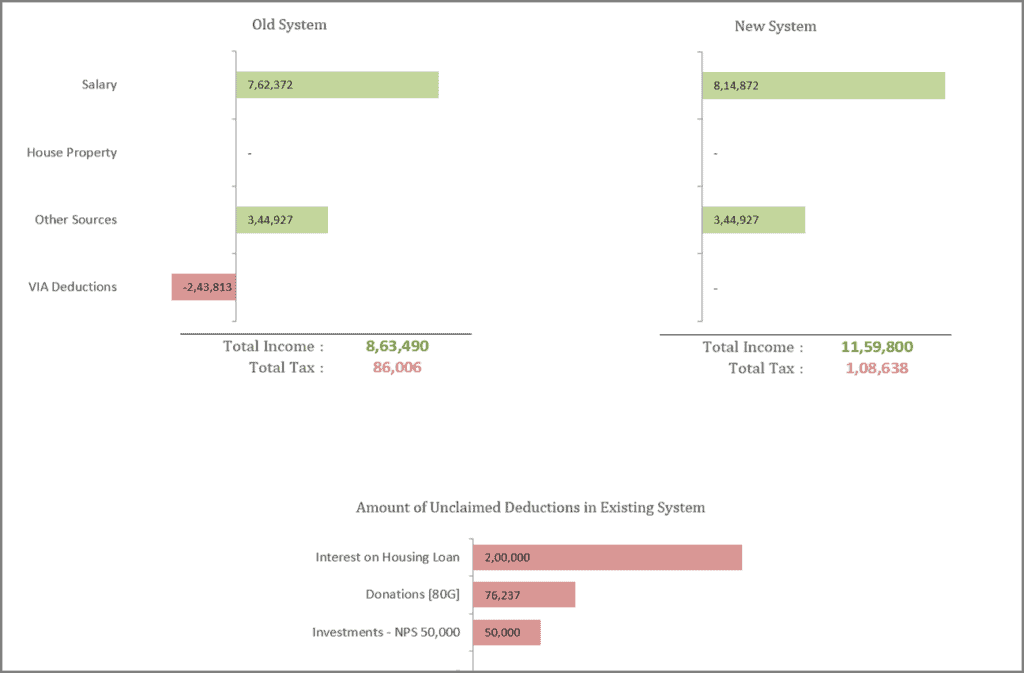

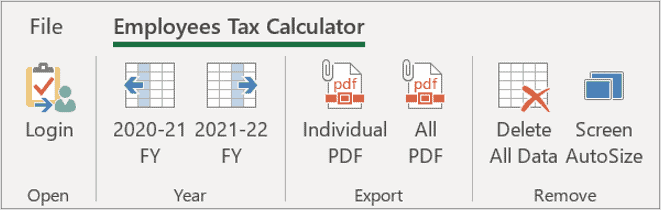

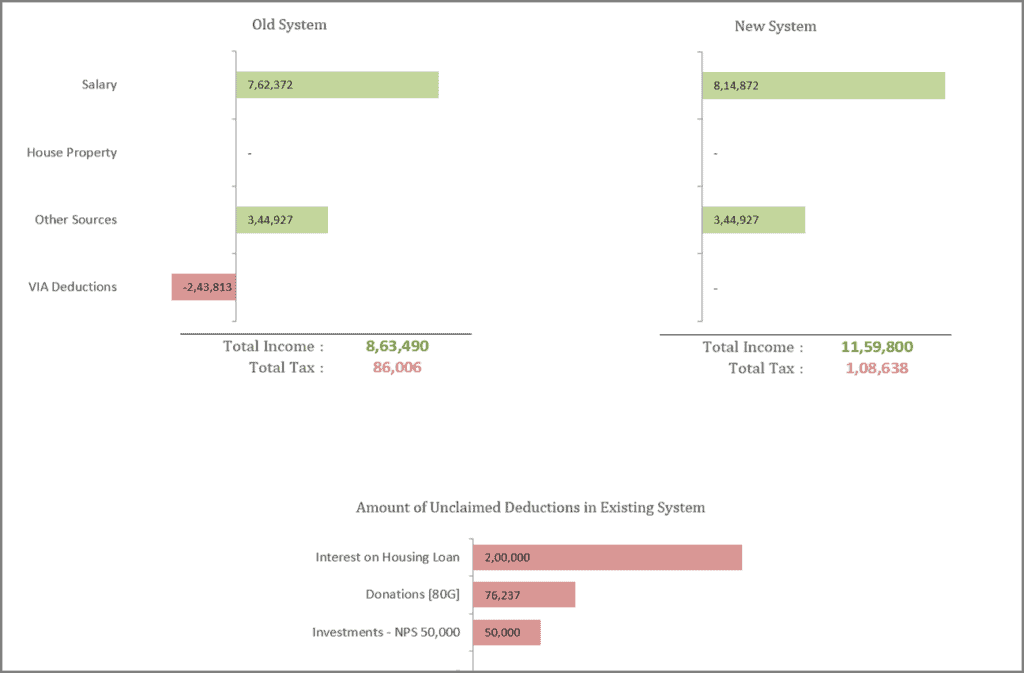

Old vs New Tax Regime Calculator. Salary tax calculator for single or multiple employees. Can also be used for monthly TDS Deduction of employees.

Features of Old vs New Tax Regime Calculator

Old vs New Tax Regime Calculator. Salary tax calculator for single or multiple employees. Can also be used for monthly TDS Deduction of employees.

Reviews

There are no reviews yet.