Fixed Asset Register

SLM and WDV Depreciation calculator as per Companies Act, and Income Tax Act. Also helpful in managing Fixed Assets.

SLM / WDV

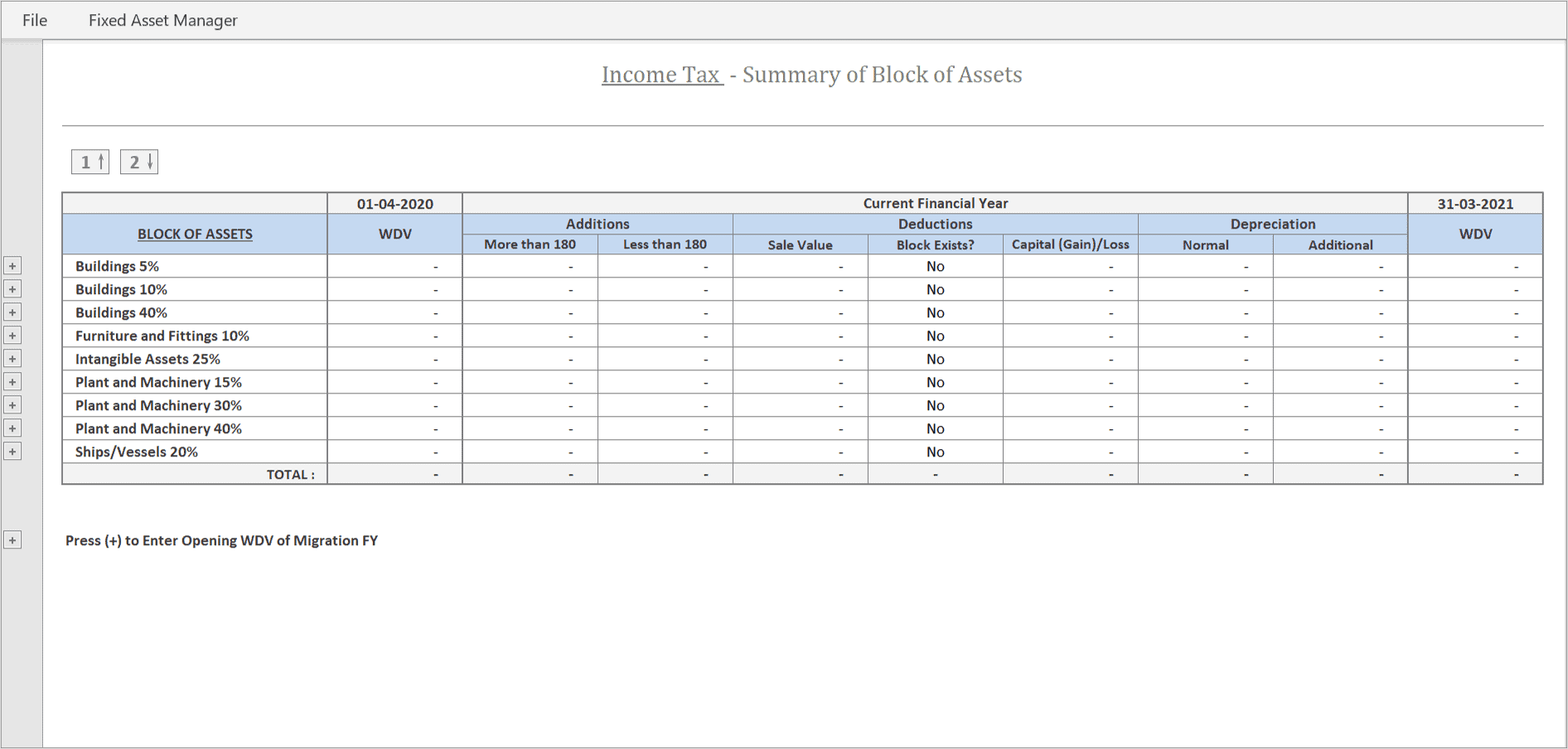

Line-wise SLM and WDV depreciation calculator as per Companies Act, Blockwise Depreciation Calculator as per Income Tax Act.

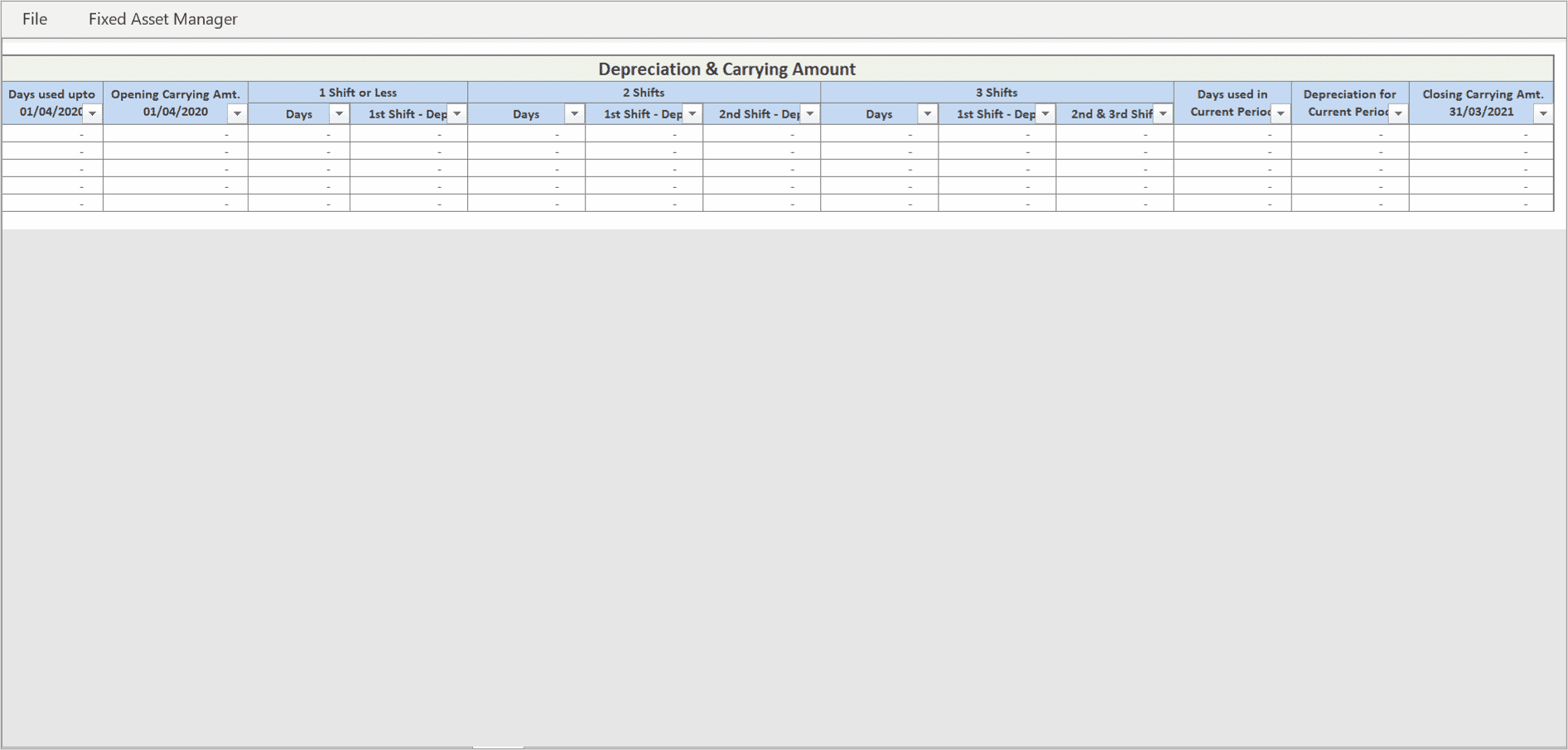

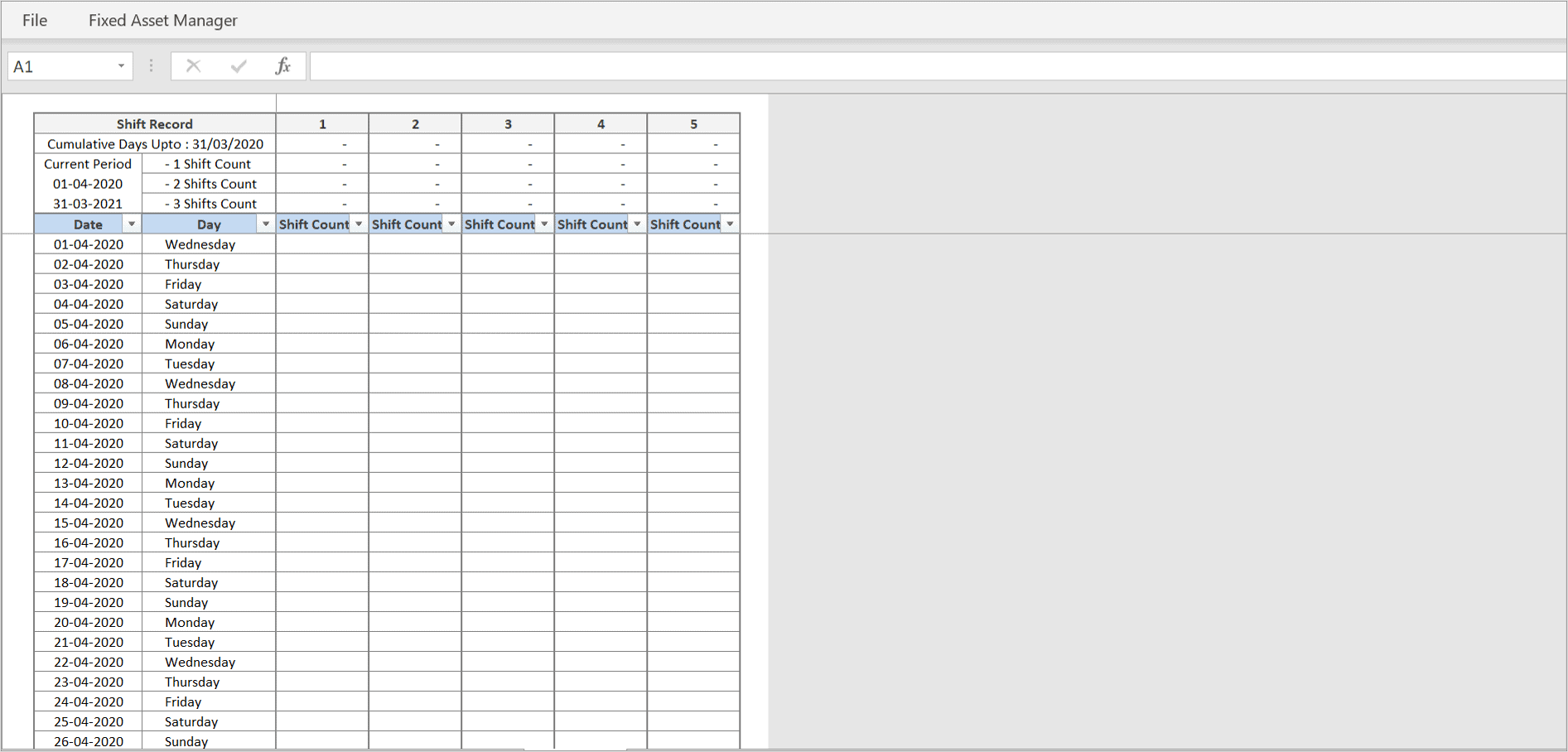

Monthly Calculation

Monthly Calculation of Depreciation for MIS Reporting, Jan-Dec Calculation for Group Reporting by Multi-National Companies.

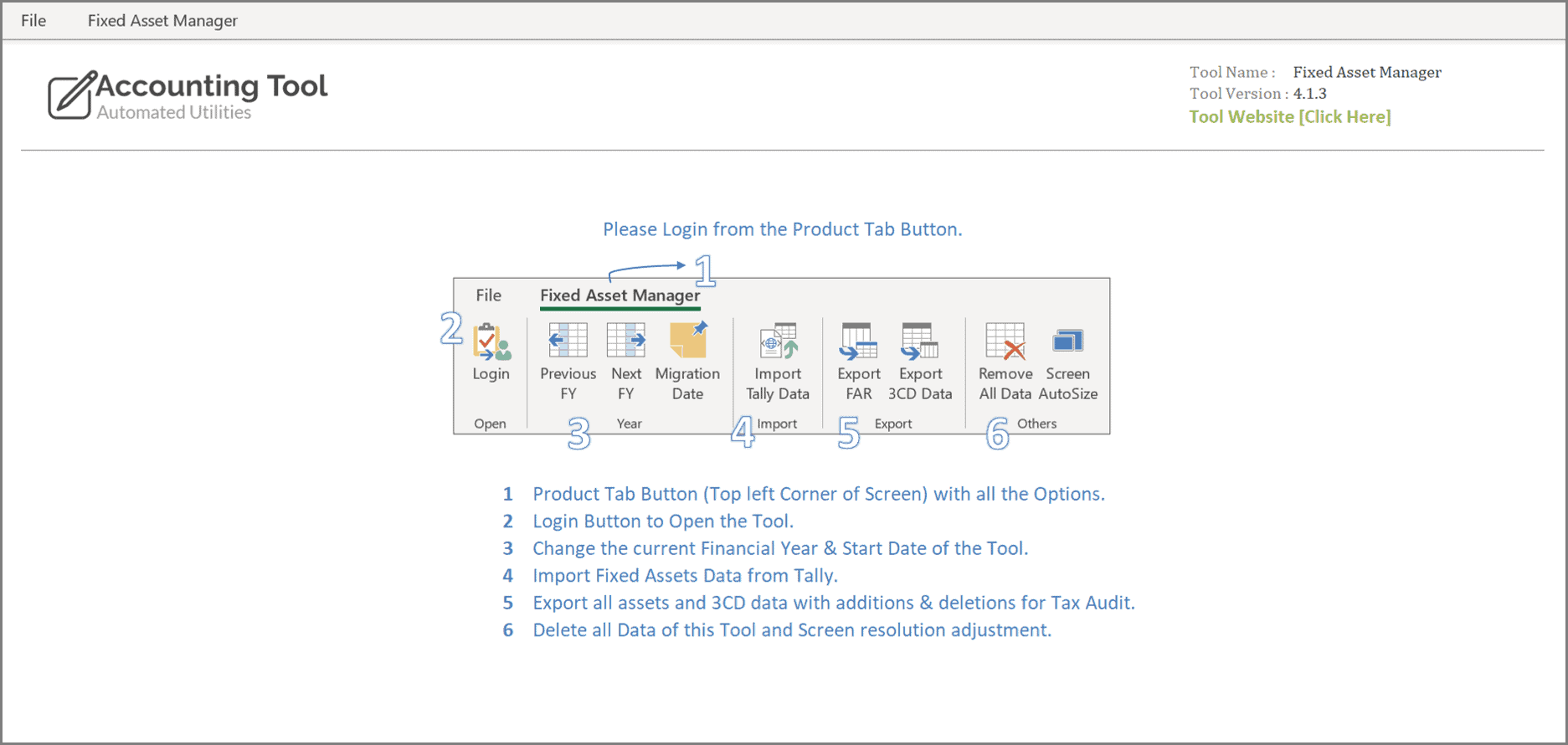

Change Year

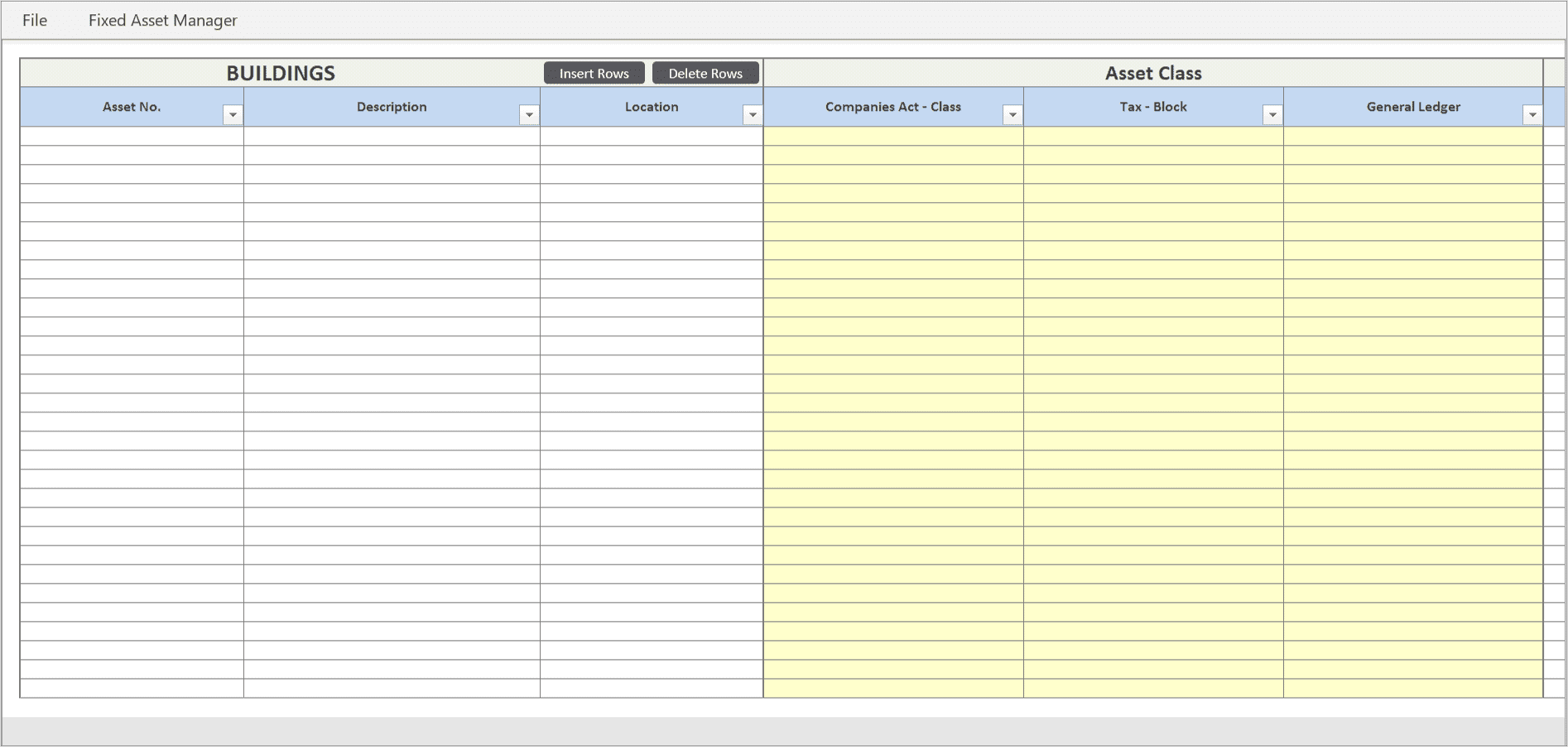

Change the Financial year along with depreciation calculation. Set a Migration Date and easily migrate data from old Fixed Asset Records.

3CD Data Export

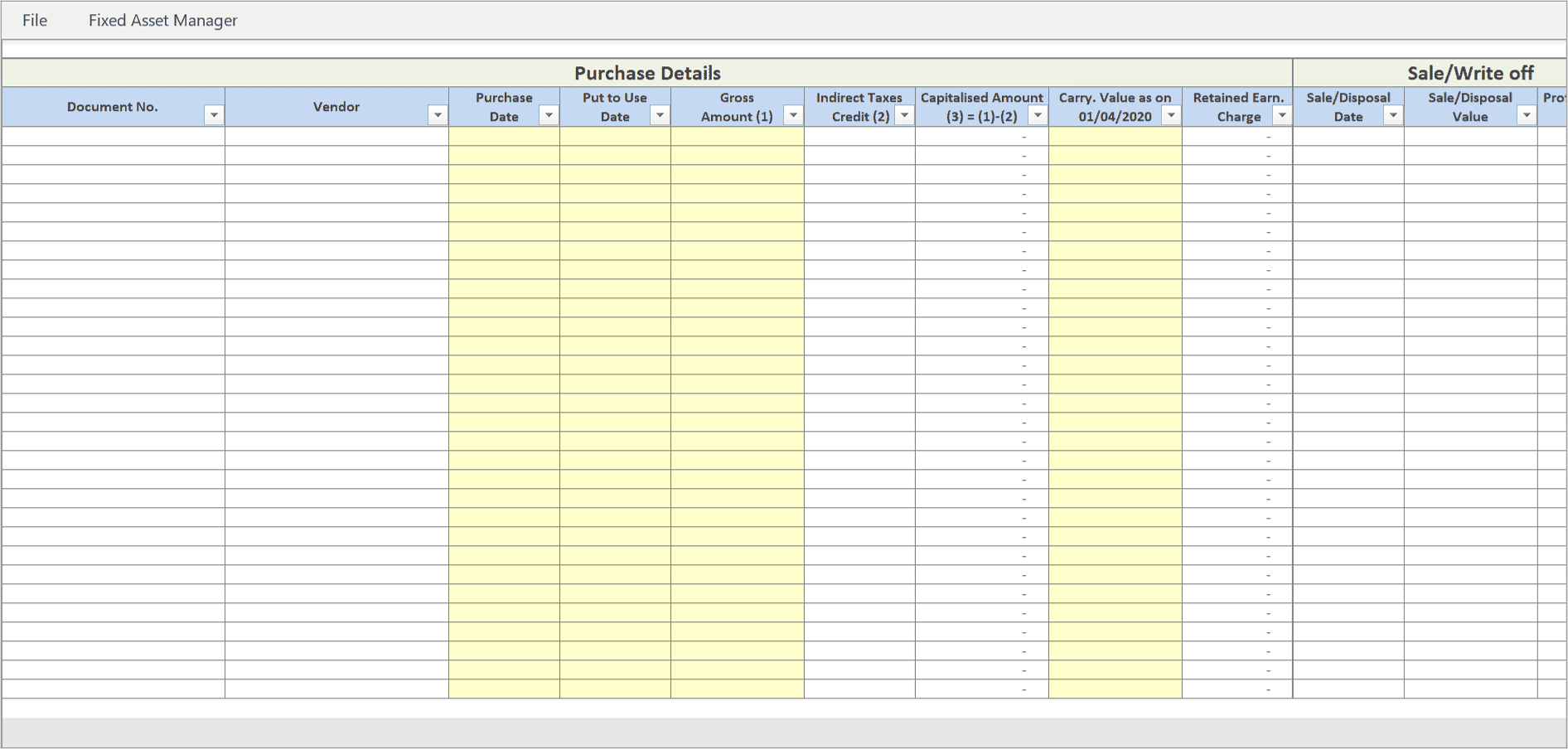

Export of Tax Audit Data for Additions and Deletions during the Year.

FAR Export

Export of all Fixed asset data in a single sheet to share with other users.

Tally Import

Direct Import of Fixed Assets data from Tally Prime & ERP 9.

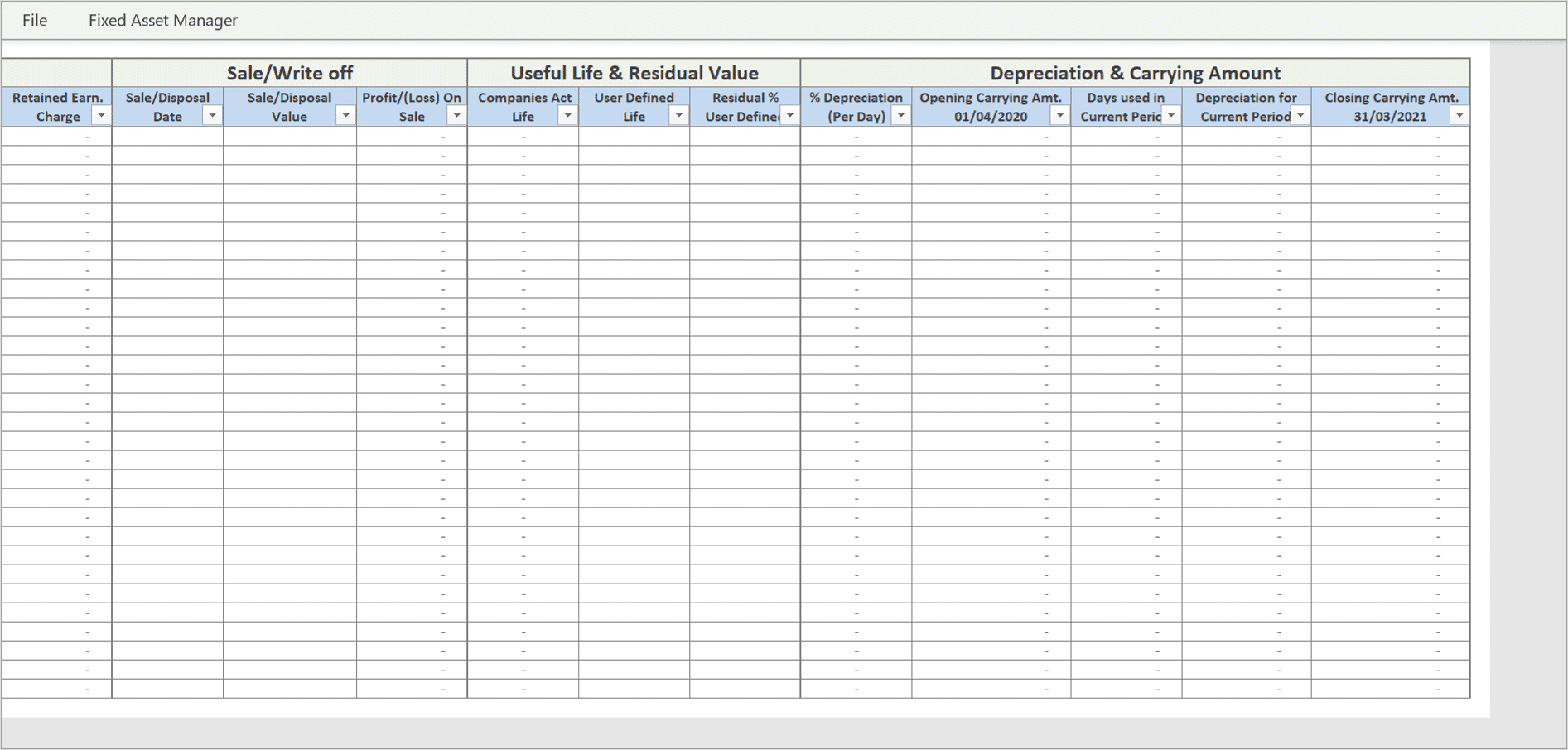

Sale of Asset

Calculation of Profit/loss and Capital Gain on Sale of Assets.

Customisation

Users can define Useful life and Residual value to best estimates.

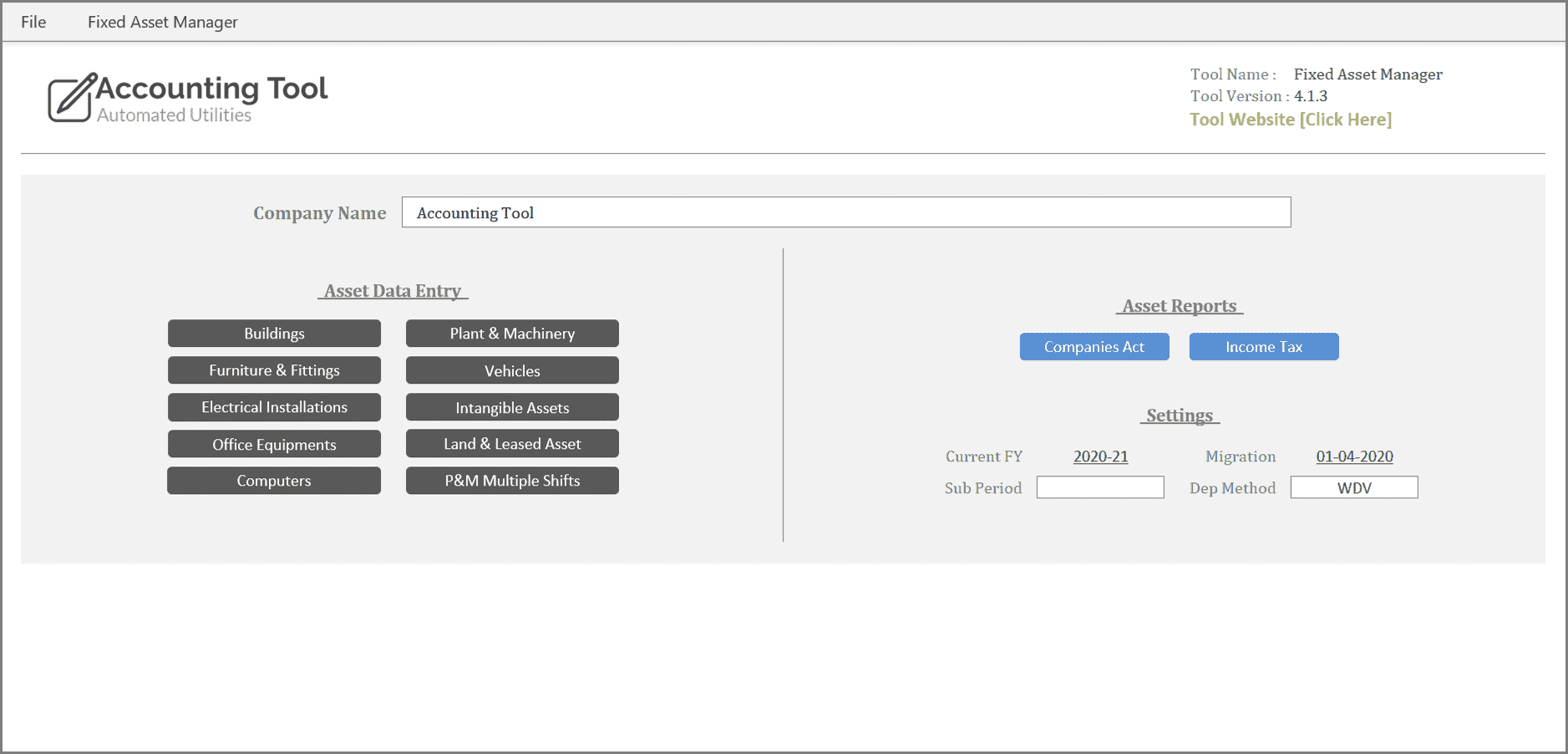

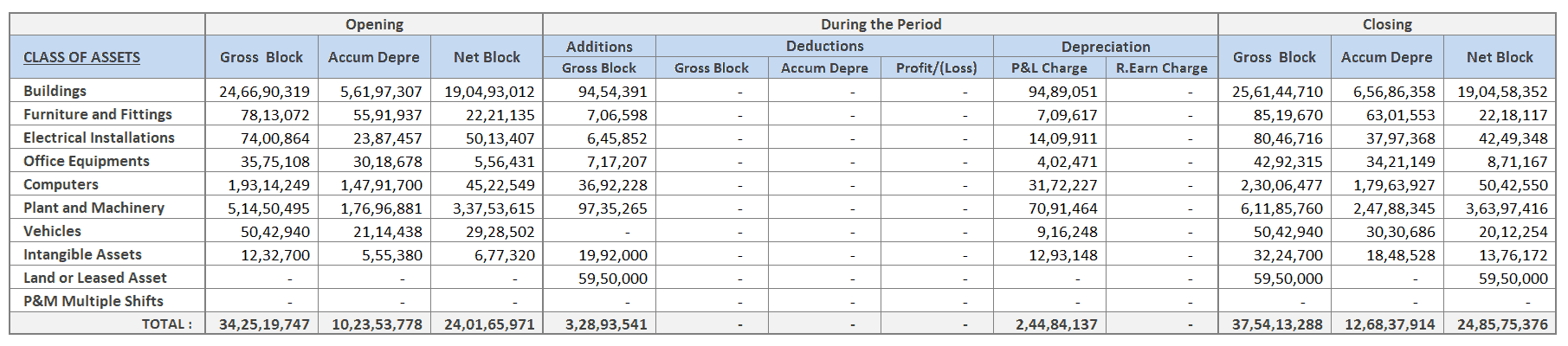

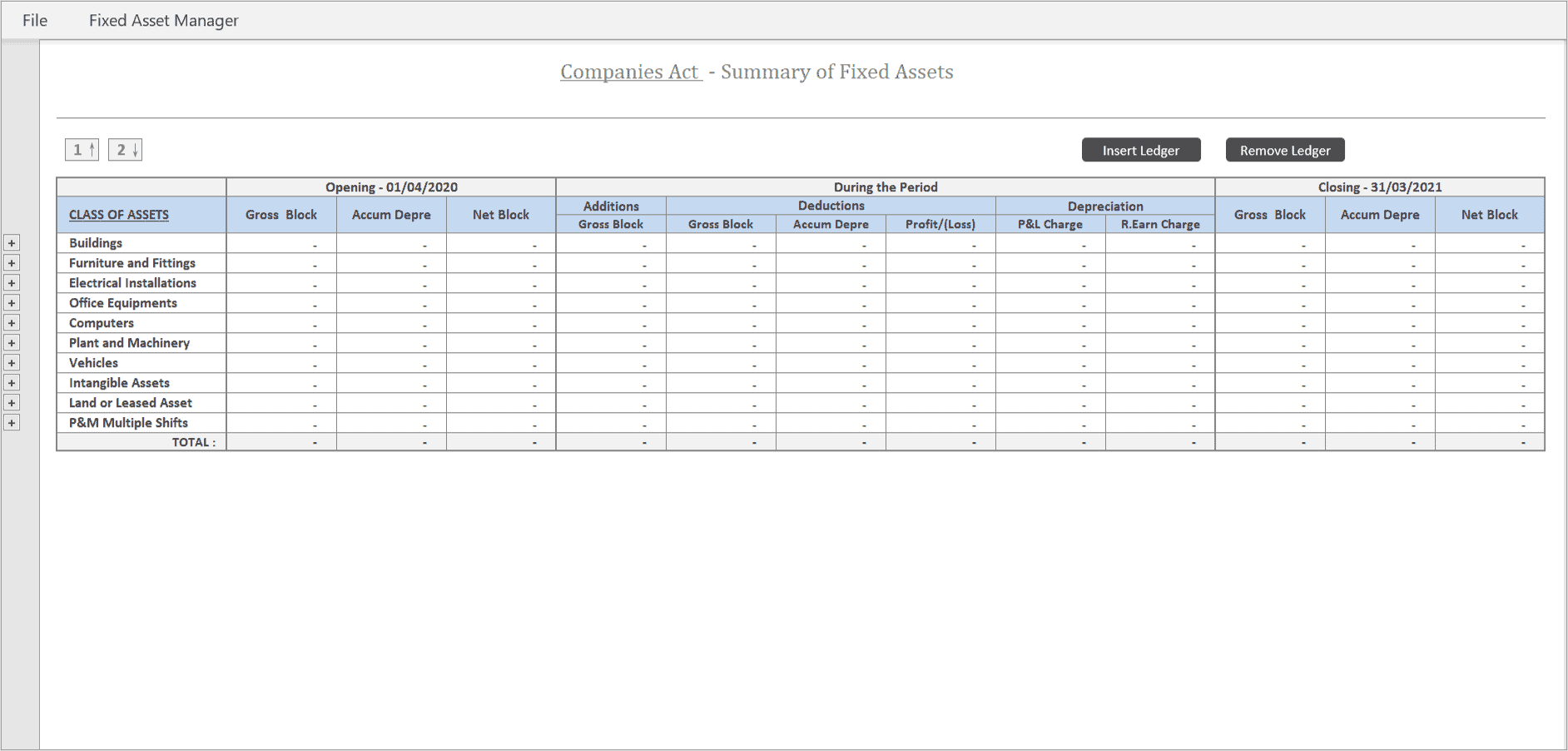

Ready Schedules

Ready-made Schedules for Balance Sheet and P&L.

Frequently asked questions

Depreciation as per Companies Act is the systematic allocation of the depreciable amount of an asset over its useful life. There are four inputs required to calculate depreciation – Useful life, Residual value, Depreciable Amount, and Ready to use Date.

Useful life is the period over which an asset is expected to be available for use by an entity. Schedule II to the Companies Act, 2013, specifies useful lives for this purpose. Calculation as per the useful life is true commercial depreciation bringing the financial statements prepared according to international standards.

Users can make calculations of depreciation as per the Companies act based on an asset’s useful life supported by technical advice, even though such lives are higher or lower than those specified in the said schedule.

The Methods of calculation of depreciation as per companies act are:

Straight Line Method – The asset is depreciated equally every year over the asset’s useful life as a percentage of the Initial Cost. Depreciation is calculated for a year and proportionately adjusted if used for less than a year.

Written Down Value Method – The method distributes the asset depreciation unevenly throughout its life. It books higher expenses in the early years as assets have higher productivity and carrying value in earlier years instead of the later years of their lives.

Unit of Production Method – The depreciation on an asset can be provided, where appropriate, based on the units expected to be obtained from the use of the asset. The calculation is based on the output capacity of the asset rather than the number of years.

Get It Now

Choose the most appropriate plan that meets your requirements.

Pro

₹1,999

1 Year, 1 PC

Plus

₹2,999

1 Year, 5 PC

Pro

₹5,999

Lifetime, 1 PC

Plus

₹8,999

Lifetime, 5 PC

Ashutosh Garg –

Best tool for Depreciation calculation for companies act and also good for maintaining asset records.

Sriram CA –

Nice product

Best for reporting and calculating depreciation working and fixed assets register maintenance as per companies act as well as income tax. Very simple to use.. Thanks !!