GSTR-2B Reconciliation Tool

Simplify GST compliance with our GSTR-2B Reconciliation Tool. Import data directly from Tally and reconcile purchase invoices with GSTR-2B and GSTR-2A, classifying ITC into matched, mismatched, and ineligible categories.

The tool also supports GSTR-1 Reconciliation to identify outward supply differences instantly.

Direct Tally Import

Import GST input data directly from Tally. ITC for Purchases, Fixed Assets, and Expenses is captured automatically—no manual uploads required.

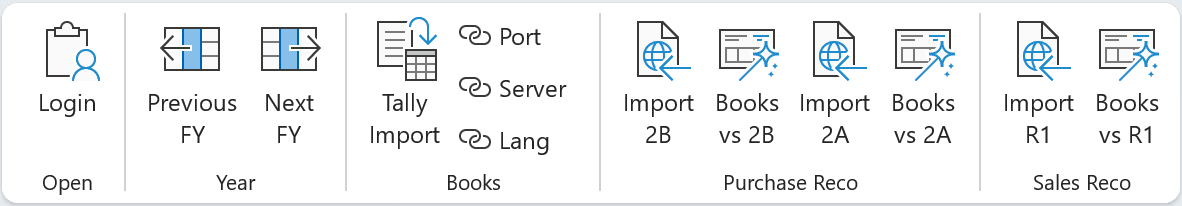

2A, 2B & R1 Import

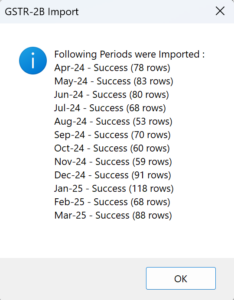

Import GSTR-2A, GSTR-2B, and GSTR-1 data directly from the GST Portal. Supports single month, 12-month, or 19-month bulk imports in one click.

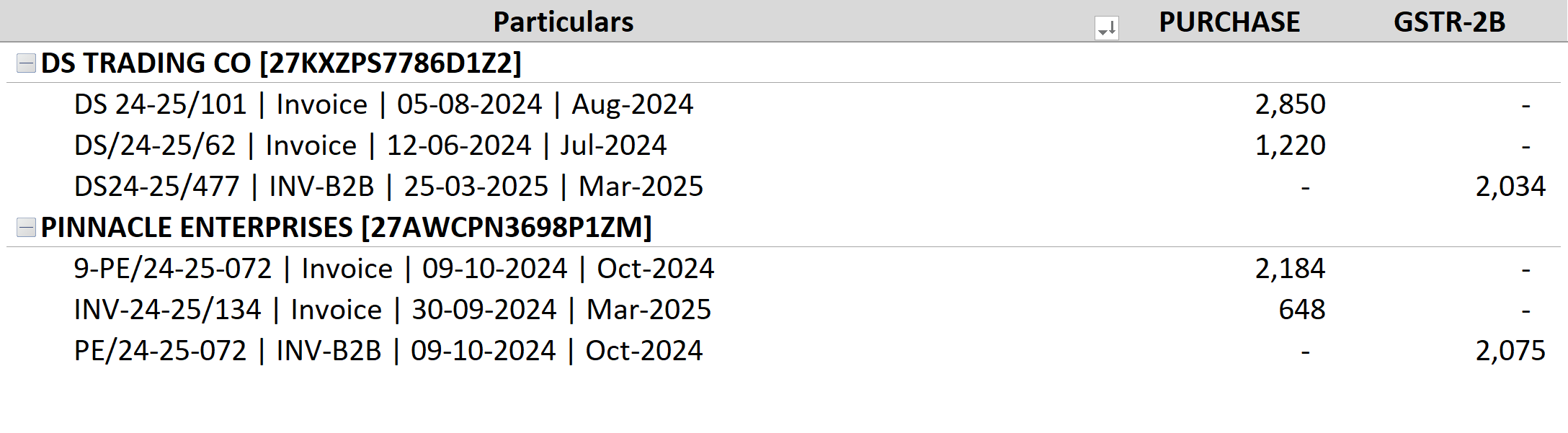

Purchase vs 2A vs 2B

Reconcile your Purchase Register with GSTR-2A and GSTR-2B effortlessly. Smart logic detects exact, partial, and probable matches.

Sales vs GSTR-1

Match your Sales Register with GSTR-1 to identify missing invoices, incorrect tax rates, or wrong values before filing or amendments.

Smart Fuzzy Matching

Advanced fuzzy matching identifies invoices even when invoice numbers or dates vary slightly, dramatically reducing reconciliation time and effort.

100% Desktop | No Cloud

Works completely offline with no data upload. A true No-Cloud solution—your data stays on your system, under your full control.

Why GST Reconciliation Is Important

Input Tax Credit can be claimed only on the basis of GSTR-2B. Any mismatch between books and GSTR-2B may result in ITC reversals, interest liability, and GST notices. Following are common monthly Reco issues.

- ❌ Supplier has not filed GSTR-1

- ❌ Incorrect GSTIN, tax rate, or invoice value reported

- ❌ ITC recorded in books but not appearing in GSTR-2B

- ❌ Sales invoices missing in GSTR-1, causing mismatches

How Our Software Helps

Our software streamlines GST reconciliation for businesses & CAs by allowing them to:

- ✔ Compare Books with GSTR-2A, GSTR-2B, and GSTR-1

- ✔ Identify eligible, ineligible & missing ITC

- ✔ Detect vendor non-compliance early

- ✔ Catch sales reporting errors before filing

- ✔ Reduce manual checking & Excel dependency

- ✔ Stay audit-ready with clear reconciliation reports

Key Features of GSTR-2B Reconciliation Tool

Direct import of GST data across multiple tax periods. The software allows users to import data in bulk from GST Portal, eliminating the need for month-wise manual uploads.

- Direct import of GSTR-1, GSTR-2A, and GSTR-2B data

- Multi-period import in a single action

- Direct Import of Purchase Register from Tally

- Import of Sales Register from Tally

- Consistent data structure across books and GST returns

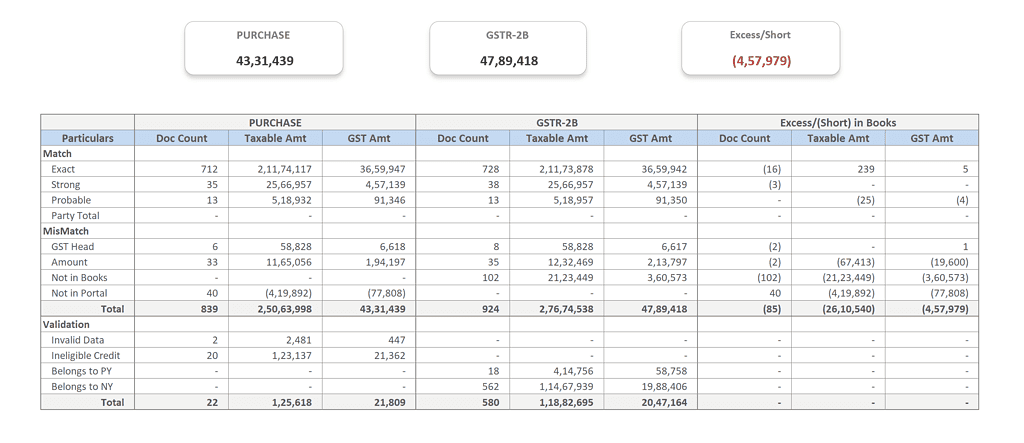

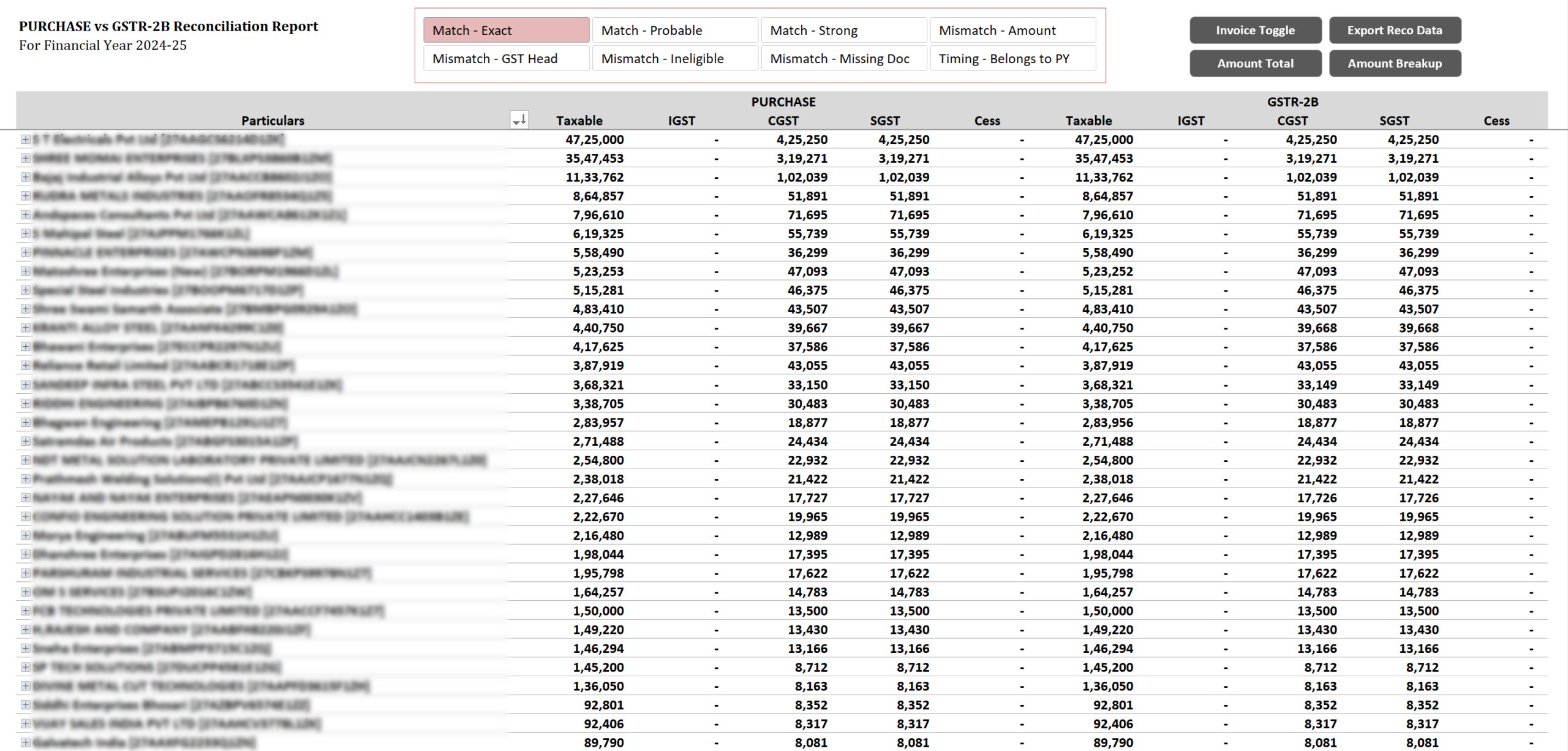

Get a complete view of your GSTR-2B reconciliation in one powerful dashboard. Instantly compare Purchase Register with GST portal data and track matched, mismatched, and missing invoices.

Clearly identify excess or short ITC in books and take action faster. Built to eliminate manual work, reduce errors, and ensure accurate ITC claims.

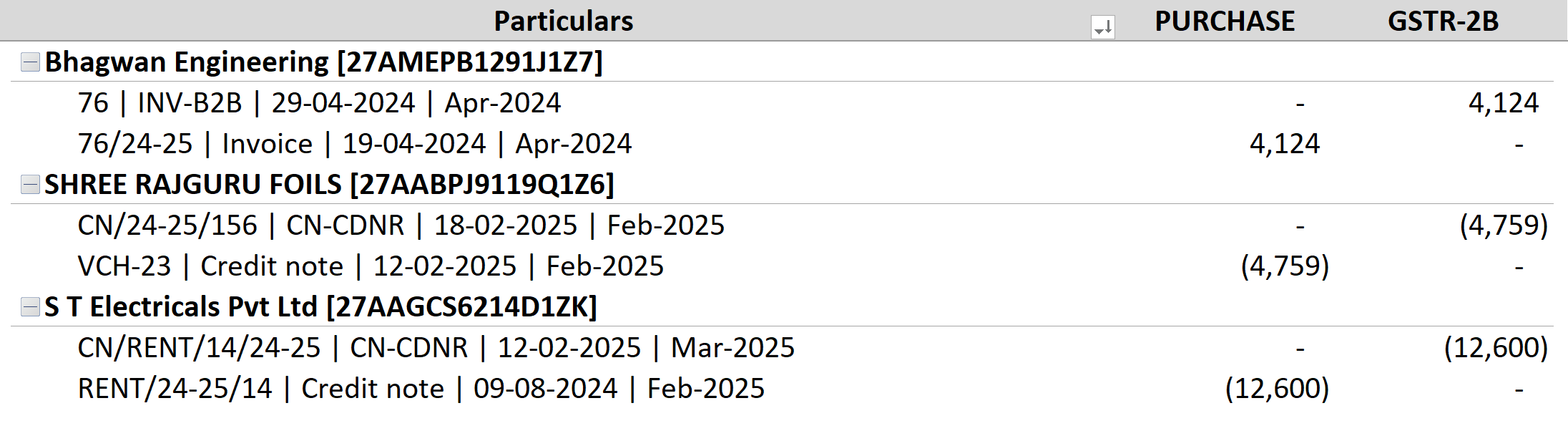

View purchase invoices reconciled with GSTR-2B in a detailed, invoice-level report. Drill down supplier-wise or invoice-wise for focused review.

Filter matched and mismatched invoices by category, and analyse tax and value differences.

Export reconciliation data instantly for compliance and audit documentation.

Match types and the required User Action

| Match Type | Meaning | User Action |

|---|---|---|

| Exact or Strong Match | These documents are present at both places with the same amount. | No action is required for these transactions. |

| Probable Match | Document numbers for these transactions could not be matched but they may be a probable match based on amounts and the document dates. | The user needs to confirm whether probably matched documents are actually matching. |

| MisMatch Amount | Document numbers for these transactions were matched but the document amounts could not be matched. | The user needs to verify all the amounts in these documents. |

| Not in Books | These documents were not found in the input credit records of the user but are present in the GST Portal. | Eligible credit – If the input credit was not recorded in books in the prior months or previous financial year then the user needs to make entries for these documents in his Books. Ineligible credit – No action is required for these transactions. |

| Not in Portal | These documents are present in the input credit records of the user but not in the GST portal. | The user needs to contact the suppliers and confirm whether they have missed the documents in their GSTR-1 returns. The user can take GST credit in the month when the supplier includes the documents in his GSTR-1. |

Get It Now

Choose the most appropriate plan that meets your requirements.

Pro

₹3,499

1 Year, 1 User

Plus

₹4,999

1 Year, Upto 5 Users*

Plus

₹7,499

1 Year, Upto 10 Users*

Pro

₹6,999

Lifetime, 1 User

Plus

₹9,999

Lifetime, Upto 5 Users*

Plus

₹14,999

Lifetime, Upto 10 Users*

*Multi-user plans are valid for a single firm operating from a single location.

Lifetime license includes 1 year of free updates & Support.

All prices are exclusive of GST. Applicable GST will be charged extra.

Reviews

There are no reviews yet.